Palladium Network Whitepaper

Version 5.6 | November 2025

Executive Summary

The Palladium Network represents a new frontier in global finance: it blends the steadiness of real estate income with the adaptive precision of automated trading strategies to create a holistic investment environment. In a world grappling with economic uncertainty, investor skepticism, and systemic imbalances, Palladium anchors digital markets to tangible value while leveraging technological sophistication to stabilize returns and improve market rationality.

Key Takeaways

- Stable Foundations: Palladium’s real estate acquisitions will provide a bedrock of predictable rental income and appreciation potential.

- Adaptive Enhancements: A dedicated trading engine identifies and profits from market inefficiencies, offsetting volatility and yielding consistent gains.

- Holistic Vision: By integrating ESG considerations and educational outreach, Palladium aims for a financial ecosystem that transcends mere profit to deliver long-term social and environmental benefits.

Background and Core Rationale

Crypto’s initial promises of democratization and frictionless global finance were overshadowed by speculation, volatility, and distrust. Traditional real estate, though stable, remained illiquid and difficult for average investors to access. Palladium merges these domains: it harnesses the power of tokenization to fractionalize prime properties, and the sophistication of algorithmic trading to smooth volatile price behavior in digital markets. The result is a model that can appeal to both conservative institutional investors and progressive crypto enthusiasts.

A Grand Synthesis: Palladium’s Philosophical and Economic Vision

At its core, Palladium is not simply another platform. It aspires to redefine how we perceive and use capital. By rooting tokens in real-world productivity, actively reducing speculation, and encouraging governance grounded in transparency and ethical considerations, Palladium heralds a shift toward more enlightened, socially responsible, and globally accessible finance.

Toward a World of Stability and Inclusivity

With a stable asset base, rational price dynamics, and universally accessible fractional ownership, Palladium envisions a future where wealth creation is less erratic, more inclusive, and more aligned with human progress. Institutional players find a trustworthy gateway into digital assets, retail investors gain access to opportunities previously reserved for elites, and communities benefit from sustainable property management and development.

Market Overview and the Grand Challenges of Our Era

Historical Evolution of Real Estate: From Ancient Landholding to Modern Global Markets

Real estate has always served as a cornerstone of wealth preservation. In ancient civilizations, landownership signified power and security. Over centuries, property markets evolved into complex, layered systems involving mortgages, REITs, global investment funds, and now tokenization. Despite these advancements, accessibility and liquidity remained challenging. Palladium capitalizes on tokenization to open these venerable assets to a broader swath of humanity, bridging millennia of tradition with digital-age innovation.

Digital Finance and the DeFi Revolution: Unlocking Global Capital Mobility

The DeFi explosion shattered conventional barriers—no longer do investors rely solely on intermediaries, business hours, or nationality-based restrictions. Yet, DeFi’s radical openness can breed instability, fostering speculation and short-termism. Integrating real estate into this digital tapestry provides foundational anchors that counterbalance hyper-volatility, encouraging more sustainable, patient capital flows.

Chronic Volatility, Speculation, and the Trust Deficit in Crypto Ecosystems

Crypto’s narrative often alternated between euphoric mania and despairing crashes. Without inherent anchors to productive assets, markets easily succumbed to fads, rumors, and psychological cycles. Palladium’s approach—linking tokens to rental income, employing automated trading to neutralize mispricing—introduces checks and balances. By providing consistent yields and reducing noise, trust can be rebuilt.

The Rise of Asset-Backed Tokenization: Real Estate as a Stabilizing Anchor

Tokenization unlocks instantaneous fractional trading of traditionally illiquid assets. Real estate becomes divisible, transferable, and globally reachable. This synergy grants crypto participants stable yield sources, lowers entry barriers for small savers, and encourages institutions to participate more confidently, knowing that tangible assets support valuations.

Broader Macro Trends: Demographic Shifts, Climate Imperatives, Geopolitical Resets

In the 21st century, societies grapple with aging populations, urbanization, migration, climate change-induced relocations, and shifting political alliances. Real estate markets respond to these mega-trends, and through tokenization, Palladium can pivot toward properties aligned with sustainable, future-oriented economic and social conditions.

Investor Psychology in Transitional Times: Flight to Quality and Demand for Transparency

Amid complex upheavals, investors seek safe harbors. They also demand more from their investments: honesty, responsibility, clear disclosures. By providing frequent reports and third-party audits, Palladium meets these heightened expectations, offering a stable alternative to short-lived speculative projects.

The Call for a Unified, Rational, and Globally Accessible Financial Infrastructure

The world yearns for financial systems that transcend outdated restrictions and moral hazards. Palladium’s integrated model, blending old-world solidity and new-world agility, points the way toward a globally cohesive framework—one that respects local nuances while maintaining universal standards of transparency, accountability, and inclusion.

The Palladium Ecosystem: Foundational Principles and Moral Imperatives

Core Ethos: Integrity, Sustainability, and The Common Good

Palladium is built on a moral foundation: finance should serve people, communities, and the planet, not vice versa. Every acquisition, buyback move, and tokenomic decision seeks to create value ethically, safeguarding long-term welfare over short-term gains.

From Individual Gain to Collective Prosperity: Reconceptualizing Investment

Beyond personal profit, Palladium encourages collective enrichment. Fractional real estate ownership diffuses wealth concentration, allowing broader demographics to partake in stable yields. This redistribution fosters resilience and aligns investment with the broader public interest.

Professional Standards and Institutional Embrace: Setting the Bar Higher

To earn institutional confidence, Palladium voluntarily adopts rigorous compliance, reporting, and operational best practices. Independent audits, recognized valuation methods, robust AML/KYC—these measures elevate Palladium above laissez-faire DeFi projects, making it a preferred vehicle for reputable firms.

A Manifesto for Trusted Investment Firms: Beyond Returns, Toward Legacy Building

Major investment houses look for more than returns—they seek meaning, enduring legacies, positive brand association. Palladium’s hybrid model speaks to this: by injecting stable capital into sustainable projects, flattening volatility, and promoting long-term thinking, it gives institutions a narrative of constructive engagement.

Aligning with ESG, Ethical Finance, and Structural Responsibility

Environmental, social, and governance considerations are integral to Palladium’s identity. Selecting properties with green certifications, community benefits, and transparent supply chains solidifies ethical credentials. Investors support not just financial outcomes, but also climate resilience, social equity, and corporate integrity.

The Role of Education, Dialogue, and Open Systems in Building Lasting Trust

Palladium will invest in education: publishing research, hosting seminars and producing explainers for novices. By demystifying complex concepts, encouraging dialogue, and maintaining open systems, it empowers informed decision-making, strengthening the social contract between platform and participants.

Automated Trading Engine: Part of the Integrated Market System

Over the years, Palladium’s trading infrastructure has incorporated a wide spectrum of automated trading strategies designed to adapt to shifting market conditions. Arbitrage remains one of the core pillars of this ecosystem—serving as a stable, low-risk strategy that complements more advanced techniques while consistently contributing to the platform’s overall performance.

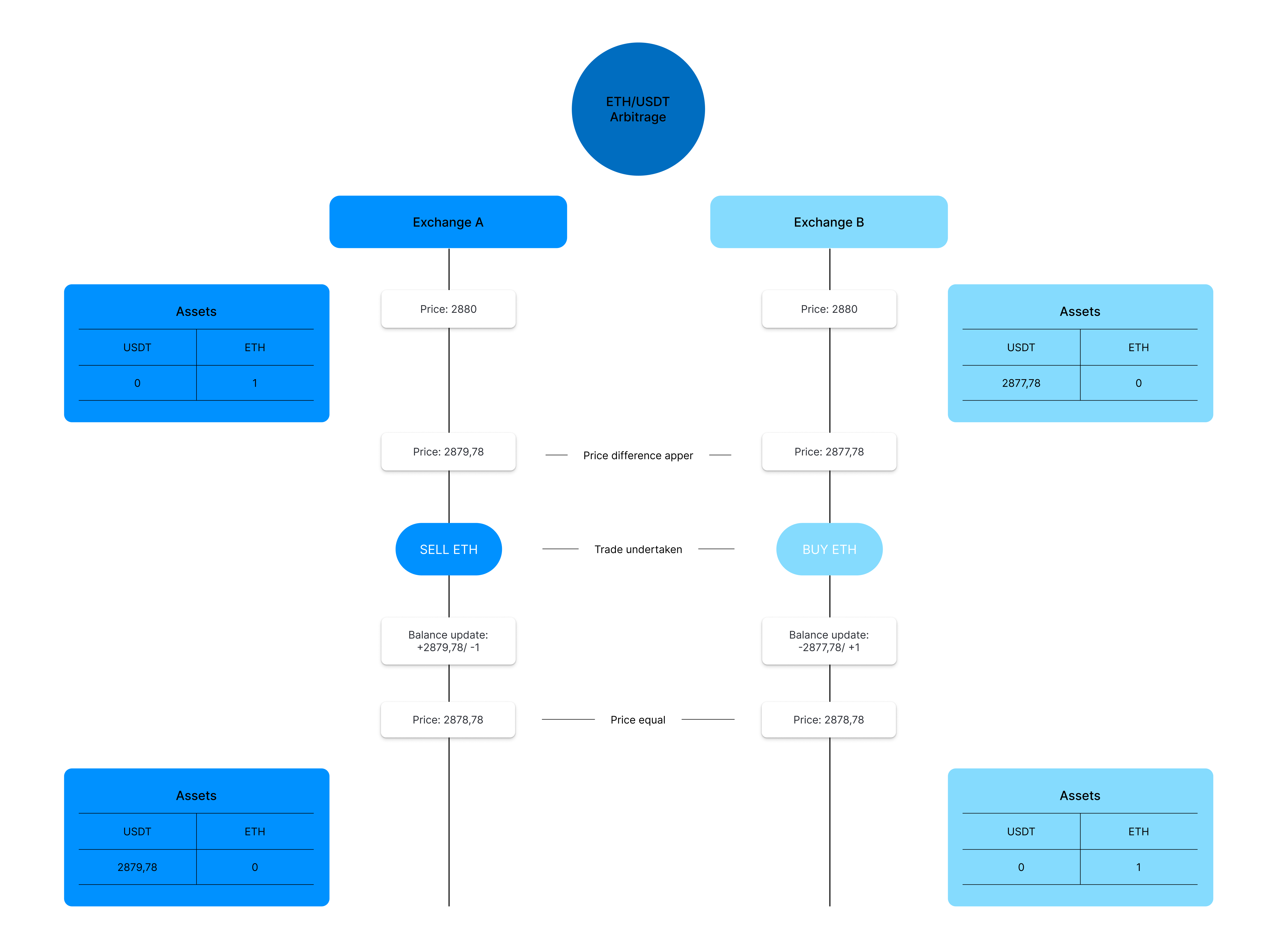

Defining Arbitrage in a Complex Multi-Chain World: Beyond Simple Price Gaps

Arbitrage is the art of profiting from price imbalances without taking on directional market risk. In traditional finance, arbitrage opportunities are often fleeting and rare due to highly efficient markets. However, in the rapidly evolving world of cryptocurrencies, price inefficiencies are more prevalent due to fragmentation across various blockchains, decentralized protocols, automated market makers (AMMs), and stablecoin liquidity pools. In crypto markets, these inefficiencies arise because assets can be traded on multiple chains and protocols, each with unique liquidity and pricing dynamics. This creates frequent price discrepancies, which skilled arbitrage strategies can exploit to generate consistent returns. In real time, Palladium's engine identifies and captures these subtle mispricing's across chains and protocols. It scans decentralized exchanges, stablecoin pools, and cross-chain bridges for arbitrage opportunities, executing trades precisely and quickly. By doing so, it not only profits from inefficiencies but also helps stabilize and rationalize the markets, improving overall liquidity and reducing extreme price divergences. This approach allows Palladium to offer a reliable, non-speculative return model by capitalizing on natural inefficiencies in a decentralized ecosystem.

Data Aggregation & Quality Assurance: The Lifeblood of Informed Decisions

High-quality data defines success. Multiple exchange feeds, fallback APIs, historical archives, and latency monitoring converge to create a unified data layer. Quality checks remove outliers, spoofed prices, and stale quotes, ensuring that the engine bases decisions on reliable facts.

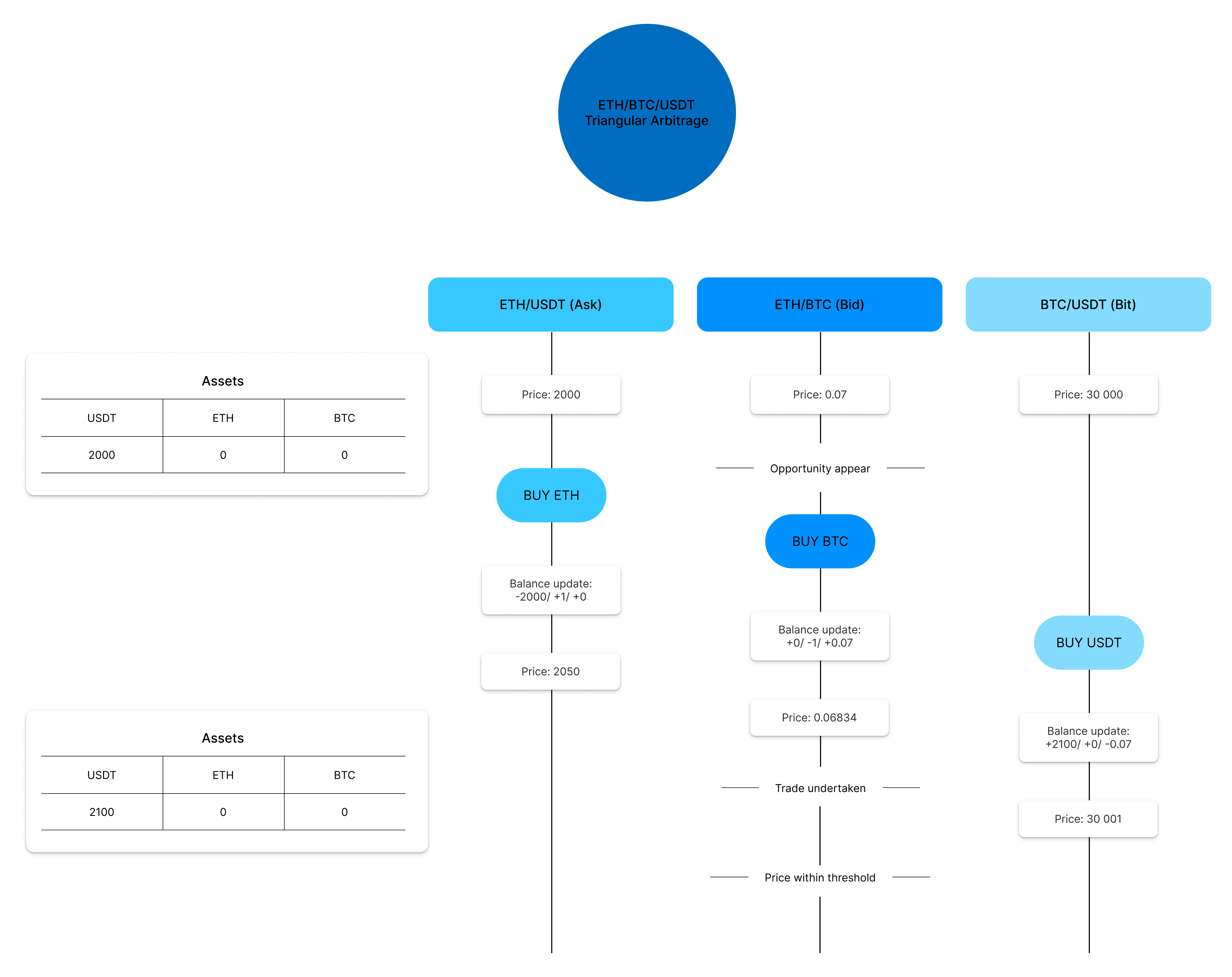

Advanced Techniques: Maker-Taker Optimization, Triangular Arbitrage, Cross-Protocol Loops

Maker-taker arbitrage earns profit by providing liquidity where spreads are wide and capturing beneficial fees. Triangular arbitrage exploits price differences between three trading pairs, while cross-protocol strategies identify price discrepancies across platforms and stable liquidity pools, maximizing risk-adjusted returns.

Latency Optimization: Infrastructure Engineering, Hardware Acceleration, and Proprietary Algorithms

Speed matters. Co-locating servers near exchange data centers, employing FPGA-based hardware acceleration, and refining code paths reduce execution times. Lower latency boosts fill probabilities, ensuring the engine seizes fleeting opportunities invisible to slower participants.

ML-Driven Insights: Predictive Models, Pattern Recognition, Continuous Risk Adjustment

Machine learning models track volatility patterns, identify seasonal liquidity shifts, and anticipate liquidity provider behaviors. This predictive ability fine-tunes arbitrage parameters: adjusting position sizes, halting trades during suspicious anomalies, and calibrating strategies as market conditions evolve.

Beyond Spot Markets: Integrating Derivatives, Futures, Synthetics, and Structured Products

Arbitrage is not limited to spot tokens. Futures markets, perpetual swaps, option chains, and synthetic asset pools all present arbitrage avenues. Hedging tools reduce directional exposure, making profits more stable and less correlated to broad market sentiment.

Arbitrage as a Force for Market Rationalization: Narrowing Spreads, Dampening Extremes

Arbitrage corrects inefficient prices, driving them toward equilibrium. Palladium’s engine indirectly contributes to stable, uniform global pricing—a public good that reduces panic-driven fluctuations by constantly extracting risk-free profits from distortions.

AI Integration and Autonomous Agents: Pioneering Intelligent Arbitrage

Looking ahead, AI-driven agents may self-learn optimal strategies, adapt to evolving protocols, and predict incoming liquidity shifts. This intelligence can outperform static rule sets, staying one step ahead of complexity, preserving returns, and stabilizing environments.

Real Estate Tokenization Models: The Pillars of Tangible Stability

RealEstate NFT Model: Stable Income Streams and Steady Appreciation

A portion of Palladium’s portfolio will be comprise of RealEstate NFT properties in stable, sought-after regions. These core holdings will generate consistent rental income, form the backbone of predictable cash flows, and provide investors a safe, familiar anchor point in an otherwise digital terrain.

Renovation-Investment Model: Capturing Upside Through Strategic Enhancements

Renovation projects target undervalued properties. By improving aesthetics, energy efficiency, layout functionality, and tenant amenities, Palladium unlocks capital appreciation. Investors partake in higher returns tied directly to successful refurbishment and subsequent premium sales.

Diversifying Across Classes: Residential, Commercial, Industrial, Agricultural, Hospitality

No single property type is immune to macro shifts. Residential units fare well during different economic climates, while commercial offices respond to business cycles. Industrial warehouses benefit from e-commerce booms, agricultural lands hedge against inflation, and hospitality assets cater to tourism waves. A balanced mix ensures resilience.

Global Footprint: Multi-Continent RealEstate NFT Strategy, Emerging Market Opportunities

Palladium’s RealEstate NFT teams scan continents, embracing stable European cities, high-growth Asian metropolises, promising African markets, and revitalizing American regions. Geographic diversity hedges against localized downturns, capturing unique growth narratives and cultural shifts.

Rigor in Due Diligence: Legal, Environmental, Infrastructural, and Social Assessments

Before tokenization of any property, thorough due diligence is paramount. Legal checks ensure clear titles, environmental inspections assess climate risks, infrastructural analyses gauge connectivity, and social reviews consider community integration. Only assets meeting strict thresholds enter the portfolio.

Fractional NFTs: Democratizing Elite Real Estate and Reducing Barriers

Traditionally, prime properties remained accessible mainly to large capital pools. Fractional tokenization distributes ownership into manageable pieces. Retail investors can now enjoy yields from trophy assets, enabling wealth-building beyond regional constraints.

Legal Structuring: SPVs, Title Validation, Compliance with Property Laws

Special Purpose Vehicles (SPVs) hold each asset, isolating liabilities and simplifying distributions. Contracts bind NFT holders’ economic claims, while title verifications and registration with local authorities uphold legality. This ensures robust investor protections and enforceable rights.

Active Asset Management: Intelligent Leasing, IoT-Enabled Maintenance, Tenant Relationship Building

Palladium employs professional managers using data-driven approaches. Sensors monitor energy usage, predictive maintenance reduces downtime, and feedback loops improve tenant satisfaction. Active management enhances long-term property value, aligning with Palladium’s stability ethos.

Property-Level Data Flows: Real-Time Occupancy Tracking, Rental Yield Analytics, Performance Dashboards

Investors can monitor occupancy rates, rental collections, and yield metrics in near real-time through dashboards. Transparency fosters trust, helping participants understand how each property contributes to overall returns and informing decisions about diversifying or concentrating holdings.

Swap Implementation: PLLD Swap for Seamless Trading

The PLLD Swap plans to be one of the key services of Palladium’s ecosystem, set to launch within 6 to 12 months after the platform’s initial release. The swap is designed to generate liquidity and simplify trading, enabling users to securely exchange PLLD tokens and other cryptocurrencies. By offering an intuitive interface and smooth transaction processes, the PLLD Swap aims to deliver an experience that is aligned with the best practices of cryptocurrency trading platforms.

How PLLD Swap Works

Wallet Connection

- Users connect their wallets via Web3 integration, enabling access to their balances for initiating swaps.

Token and Chain Selection

- The user selects the cryptocurrency they wish to swap and the blockchain network on which the transaction will occur.

Real-Time Pricing and Confirmation

- The platform displays live market prices, estimated slippage, and transaction details for user confirmation before proceeding with the swap.

Seamless Swap Execution

- Transactions are executed securely within the ecosystem, and the exchanged cryptocurrency is credited directly to the user's upon completion of the swap.

Benefits of PLLD Swap

-

Enhanced Liquidity:

- The swap ensures consistent and deep liquidity for PLLD tokens and other supported cryptocurrencies, providing a reliable trading environment.

-

Synergy with Arbitrage Engine:

- The PLLD Swap complements the platform's arbitrage engine by optimizing liquidity channels and enhancing price efficiency. This synergy ensures users benefit from stable token values and tighter spreads, indirectly contributing to the broader ecosystem's rationalization.

Future Plans for PLLD Swap

-

Expanded Token Support:

- The swap will continually expand its range of supported tokens and trading pairs to enhance utility.

-

Advanced Analytics:

- Future iterations may include market analytics and order customization features for more strategic trading.

-

Incentive Programs:

- Users may benefit from loyalty rewards, reduced fees for PLLD holders, and other promotional incentives to encourage engagement.

-

Integration with Ecosystem Features:

- The PLLD Swap will integrate with Palladium’s broader offerings, such as NFT investments, ensuring a cohesive user experience across all products.

Utility of the PLLD Token: Economic Incentives and Ecosystem Synergy

The PLLD token is designed to capture value generated by Palladium’s sophisticated automated trading strategies, creating a straightforward but powerful profit-sharing mechanism. Unlike NFTs, which tie returns to specific real estate properties, PLLD tokens focus exclusively on arbitrage-derived value—ensuring distinct, transparent benefit streams for each participant type.

PLLD as a Keystone Asset: Bridging Trading Success with Investor Rewards

PLLD tokens connect investors to the potential profitability of automated trading without requiring any hands-on market activity. While Palladium’s high-performance engine aims to secure consistent returns, no yields are guaranteed:

-

Scalable Growth Automated trading strategies exploit crypto market inefficiencies to pursue reliable gains, but market volatility can affect outcomes.

-

Predictable Returns Regular buybacks—funded solely by trading profits—help PLLD holders share in the platform’s success. However, actual results may vary based on broader market conditions and unforeseen risks.

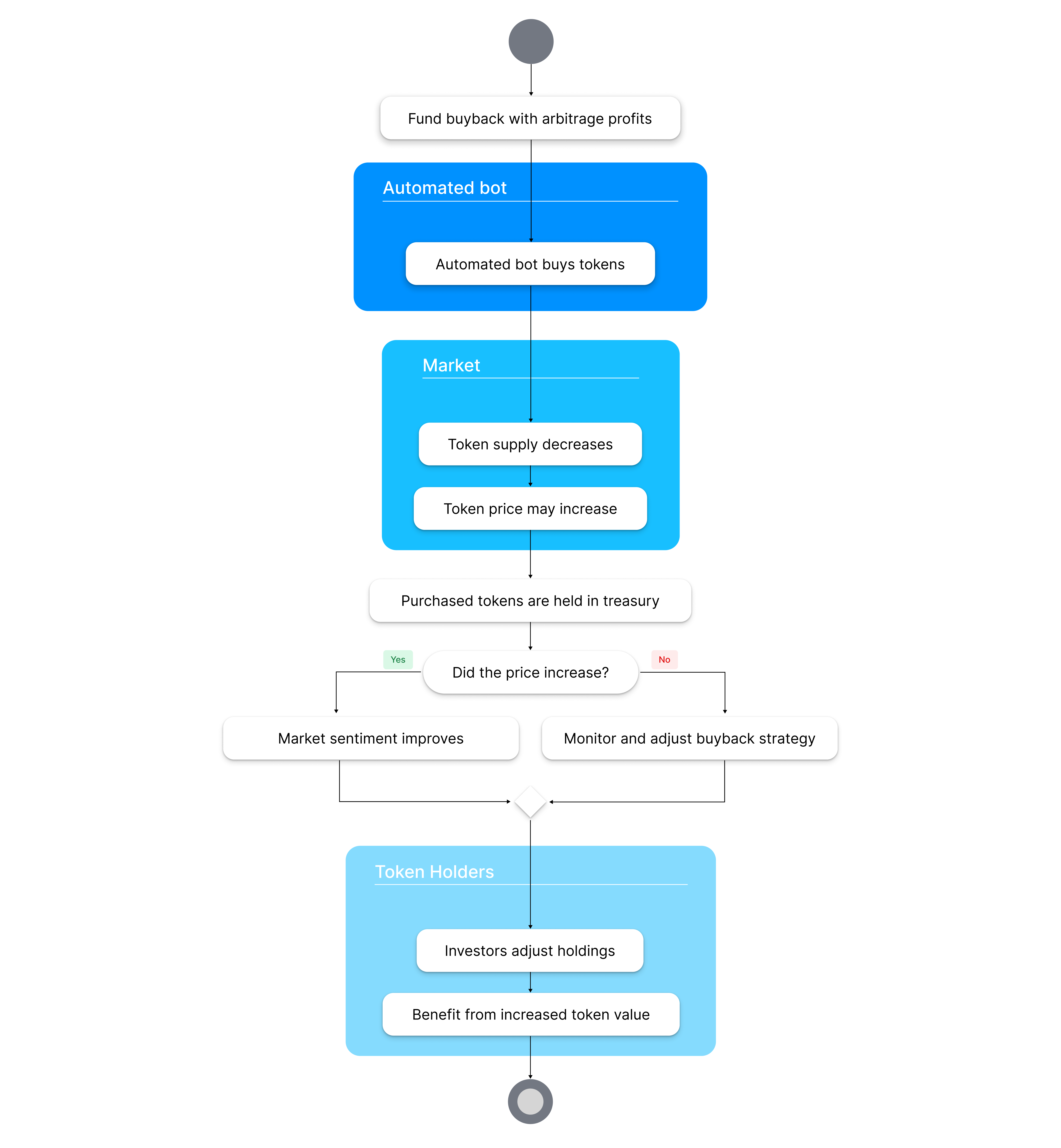

Profit-Sharing Through Buybacks

Palladium’s direct, transparent profit-sharing model leverages trading proceeds to support PLLD tokens:

-

Buybacks from Trading Profits A percentage of trading profits is periodically allocated to buying PLLD on the open market—boosting demand and potentially strengthening the token price.

-

Redistribution of Value Purchased tokens remain in the company’s treasury, reducing the circulating supply and indirectly supporting PLLD’s market position.

-

Transparency Regular performance announcements summarize automated trading activity, buyback schedules, and the total tokens repurchased, ensuring holders have a clear view of token dynamics.

Distinction Between Real Estate NFTs and PLLD Tokens

Separating real estate yields from trading revenues ensures clarity for different investor preferences:

-

Real Estate Income for NFT Holders Rental income and appreciation benefits accrue exclusively to holders of fractional real estate NFTs—those investing directly in specific properties.

-

Trading Profits for PLLD Holders In contrast, PLLD buybacks flow solely from trading success, providing a channel for investors who prefer a market-based (rather than property-based) reward structure.

PLLD as a Benchmark: Redefining Token Buybacks

By anchoring PLLD’s value to trading profits, Palladium underscores simplicity and traceability:

-

Clear Purpose Linking token returns directly to trading results avoids overlapping income sources, simplifying the investment proposition.

-

Trust and Reliability Publicly verifiable buybacks based on trading outcomes build holder confidence—though no profit can be guaranteed.

-

Industry Inspiration PLLD demonstrates how decentralized finance and real asset tokenization can coexist, setting an example for other platforms seeking clear, profit-sharing mechanisms.

Driving Rational Behavior: Stability Over Speculation

By focusing on trading earnings rather than hype-driven token emissions, Palladium promotes healthier market conduct:

-

Measured Growth Buybacks can support long-term token appreciation, but all participants should be mindful of inherent market risks.

-

Data Transparency Published buyback data allow investors to base decisions on evidence rather than speculation.

-

Market Maturity Minimizing reckless price pumps and focusing on tangible value creation can encourage deeper liquidity and reduced volatility across the ecosystem.

Informal Influence via Feedback Channels

Palladium values continuous engagement, inviting PLLD holders to shape trading operations:

-

Arbitrage Strategy Feedback Community suggestions for underexplored crypto markets or trading pairs can inform future expansions, aligning platform direction with investor insight.

-

Transparent Communication Regular updates, open Q&A sessions, and AMA events keep stakeholders informed about platform milestones, strategic pivots, and performance trends.

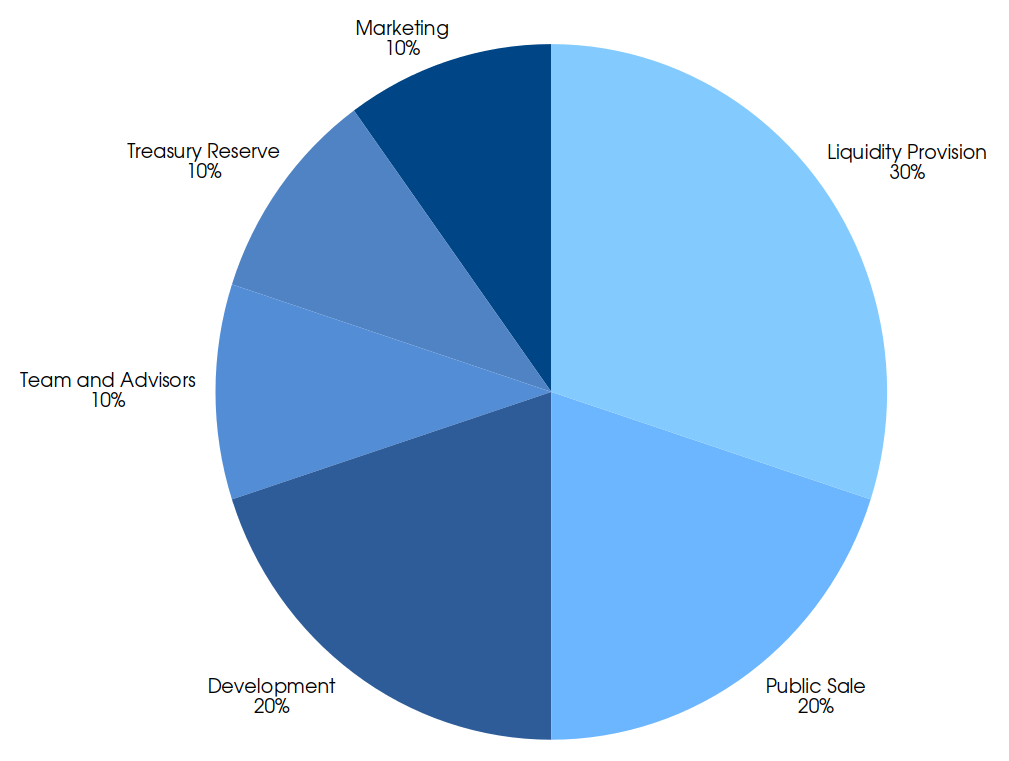

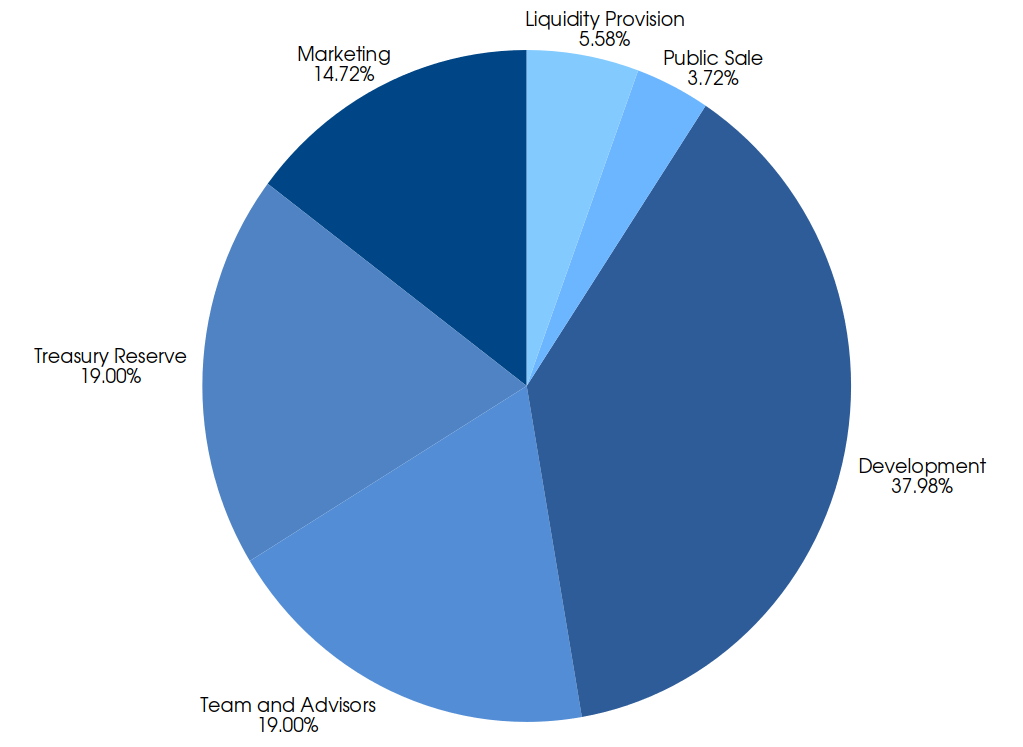

Tokenomics and Distribution: Comprehensive Post-Burn Framework

A transparent and accurate tokenomics model is essential for Palladium’s credibility. While the genesis mint created 100,000,000 PLLD tokens, subsequent strategic supply reductions, through open-market buybacks and permanent burns, have lowered the circulating supply down to 52,643,000 PLLD without altering any locked or vesting allocations.

Because no vesting unlocks have occurred to date of so far executed burns, all long-term allocations (Development, Team, Treasury Reserve) remain fully intact at their original amounts.

The 47,357,000 PLLD burned were sourced from a combination of unlocked categories and tokens repurchased via treasury buybacks, ensuring that the project’s locked commitments and vesting schedules remain unaffected.

| Allocation Category | Genesis % | Genesis Allocation | Current % | Current Allocation |

|---|---|---|---|---|

| Liquidity Provision | 30% | 30,000,000 PLLD | 5.58% | 2,938,857 PLLD |

| Public Sale | 20% | 20,000,000 PLLD | 3.72% | 1,959,238 PLLD |

| Development | 20% | 20,000,000 PLLD | 37.98% | 20,000,000 PLLD |

| Team and Advisors | 10% | 10,000,000 PLLD | 19.00% | 10,000,000 PLLD |

| Treasury Reserve | 10% | 10,000,000 PLLD | 19.00% | 10,000,000 PLLD |

| Marketing | 10% | 10,000,000 PLLD | 14.72% | 7,744,905 PLLD |

| Total | 100% | 100,000,000 PLLD | 100% | 52,643,000 PLLD |

These allocations serve strategic needs—from ensuring robust liquidity and continuous development to fostering community adoption and long-term sustainability.

Vesting Schedules

1. Liquidity Provision (30% at Genesis, 5.58% Current)

- Initial Unlock: Fully unlocked at the TGE to create liquidity pools.

- Management: Tokens are managed under a multisignature wallet accessible only by the core team, ensuring security and transparency.

- Rationale: Provides sufficient liquidity at launch and flexibility for managing decentralized and centralized exchange pools as required.

- Burn Adjustment: A proportional share of the unlocked Liquidity Provision supply was burned, reducing this category significantly from 30,000,000 PLLD to 2,938,857 PLLD.

2. Public Sale (20% at Genesis, 3.72% Current)

- Unlock Schedule: Fully unlocked during the Token Generation Event (TGE).

- Rationale: Ensures immediate liquidity and incentivizes participation during the launch phase of PLLD token.

- Burn Adjustment: A proportional share of the Public Sale supply was burned, reducing this vesting schedule from 20,000,000 PLLD to 1,959,238 PLLD.

3. Development (20% at Genesis, 37.98% Current)

- Lockup Period: 6 months post-TGE

- Monthly Vesting:

- Months 7–12: 1,250,000 tokens released monthly.

- Months 13–18: 1,670,000 tokens released monthly.

- Months 19–25: 1,040,000 tokens released monthly.

- Rationale: Aligns funding with critical milestones, such as the launch of the Swap platform (6 months) and Real Estate solutions (12 months).

- Sablier Lockup: https://app.sablier.com/vesting/stream/LK-1-4606/

4. Team and Advisors (10% at Genesis, 19.00% Current)

- Lockup Period: 6 months post-TGE.

- Monthly Vesting: Tokens vest linearly over 25 months (400,000 tokens/month).

- Rationale: Encourages long-term alignment with project success while preventing large sell-offs.

- Sablier Lockup: https://app.sablier.com/vesting/stream/LK-1-4607/

5. Treasury Reserve (10% at Genesis, 19.00% Current)

- Lockup Period: 12 months post-TGE.

- Monthly Vesting: Tokens vest linearly over 25 months (400,000 tokens/month).

- Rationale: Provides flexibility for unforeseen needs and strategic opportunities.

- Sablier Lockup: https://app.sablier.com/vesting/stream/LK-1-4609/

6. Marketing (10% at Genesis, 14.72% Current)

- Initial Unlock: 25% (2,500,000 tokens) at the TGE for marketing campaigns.

- Monthly Vesting: Remaining 75% (7,500,000 tokens) released over 12 months (625,000 tokens/month).

- Rationale: Supports ongoing marketing efforts while avoiding sudden market dumps.

- Sablier Lockup: https://app.sablier.com/vesting/stream/LK-1-4615/

- Burn Adjustment: The initially unlocked 2,500,000 PLLD supply was reduced proportionally through the burn, leaving 244,905 PLLD remaining from the unlocked portion.

Integrated Role of Burns and Buybacks

Burns permanently eliminate supply, while buybacks remove tokens from circulation via treasury accumulation. Together, they:

- Reinforce scarcity

- Maintain market rationality

- Connect token value to actual economic activity

- Provide a transparent, evidence-driven approach to long-term token sustainability

This comprehensive post-burn tokenomics framework positions PLLD as a disciplined, scarcity-backed asset with direct ties to Palladium’s trading engine and real-estate tokenization strategies.

Buyback Mechanism: Enhancing Token Value and Ecosystem Stability

A core pillar of our tokenomics is the buyback mechanism, which uses a share of automated trading engine profits to repurchase PLLD tokens on the open market. This model stabilizes the token’s price by reducing supply, reinforcing demand, and linking PLLD value directly to the platform’s real-world trading success. The diagram below highlights each step of this cycle, from generating arbitrage revenue to finalizing token buybacks.

Complex Revenue Flows

Palladium’s treasury benefits from diverse revenue streams, ensuring financial stability and growth:

- Rental Income: Monthly property yields contribute steady cash flow.

- Renovation Gains: Value-add flips from property renovations enhance asset value.

- Trading Profits: Ongoing multi-chain trading strategies generate additional income.

Stealth Buybacks & Quarterly Documentation

-

Frequency & Method Palladium executes buybacks at random intervals to avoid predictable patterns and mitigate front-running risks. This “stealth” strategy ensures a fair market environment and helps maintain price stability.

-

Allocation A minimum of 70% (and up to 100%) of trading profit is allocated to open-market repurchases of PLLD. This direct link between profitability and token demand underscores our commitment to aligning long-term value with actual performance.

-

Impact

- Supply Reduction: Reduces circulating tokens, potentially boosting PLLD’s market value.

- Value Alignment: Reflects real ecosystem earnings in token price, benefiting committed holders.

- Holder Rewards: As supply contracts over time, long-term holders may see appreciation in value.

-

Quarterly Reporting Every 3 months, Palladium publishes detailed buyback statistics, including the total amount spent, transaction IDs or a statement from CEX, and any resulting changes in supply. These updates reinforce trust by allowing stakeholders to verify on-chain data and track the platform’s ongoing success.

Token Burning Mechanism: Long-Term Scarcity and Supply Discipline

In addition to Palladium’s buyback-driven value framework, a structured token burning program reinforces long-term scarcity, strengthens market confidence, and aligns the circulating supply with the ecosystem’s maturing fundamentals. Token burns operate as a complementary deflationary measure to buybacks, ensuring that PLLD remains grounded in responsible monetary policy rather than unchecked emissions or inflationary drift.

Historical Burns: Early Foundations of Deflationary Strength

As of November 2025, Palladium has permanently eliminated 47,357,000 PLLD from the supply—almost half of the genesis mint. These burns stem from treasury reductions, ecosystem optimization, and strategic moves to reinforce scarcity in the early development phases.

Long-Term Supply Objective: A Target of 30,000,000 PLLD

Palladium’s long-term intention is to reduce total supply to approximately 30 million PLLD, creating a lean monetary base that enhances value alignment with real-world productivity and trading-engine performance. This target supply offers:

- Scarcity: Increasing long-term value alignment and preventing inflationary drift

- Liquidity Balance: Ensuring enough tokens remain for exchange market depth and user accessibility

- Strategic Flexibility: Allowing treasury structuring, buybacks, and burns to coexist harmoniously

Ongoing Burn Schedule: Minimum Annual Reduction

Palladium commits to executing continuous burn events, occurring:

- At minimum once per year, and

- As frequently as ecosystem milestones and trading profitability justify

Burn triggers may include surplus treasury reorganizations, major platform expansions, automated trading performance cycles, and supply recalibrations during acquisition of real-estate tokenization phases.

Transparency and Verification: Immutable On-Chain Proof

All token burns are conducted directly to the Ethereum null address:

0x0000000000000000000000000000000000000000

Each burn includes:

- Transaction hashes

- Pre-burn and post-burn circulating supply values

- Explanations of the strategic rationale

These are disclosed in Palladium’s transparency reports, enabling all participants to independently verify supply changes on-chain.

Complementing the Buyback Mechanism

While buybacks accumulate tokens and remove circulating supply indirectly, burning permanently removes tokens from existence, creating:

- A hard-scarcity backbone

- Reduced long-term dilution risk

- Enhanced alignment between trading performance and token sustainability

Together, these mechanisms form Palladium’s deflationary architecture—one that grows stronger as trading operations scale and real-estate yield pipelines expand.

Secondary Markets: Ensuring Liquidity and Stability

Market Makers

To avoid illiquid trading conditions, Palladium collaborates with reputable market makers who maintain orderly order books on various exchanges. This partnership ensures that PLLD remains accessible and tradable, fostering a reliable trading environment for all participants.

Stability Funds

In periods of abrupt volatility, the project may deploy stability reserves from the Treasury to smooth severe price swings. This mechanism reassures participants—especially institutional investors—that the project is designed to mitigate irrational panic selling, thereby maintaining confidence in PLLD's value.

Scenario Modeling: Navigating Challenges

Robust scenario modeling anticipates potential global or sector-specific challenges, such as interest rate spikes, sudden crypto regulatory actions, or commodity supply-chain issues. Depending on the scenario, Palladium can:

- Adjust Trading Strategies: Shift focus to more defensive trades to preserve capital.

- Modulate Token Releases: Defer certain vesting unlocks or buyback plans if liquidity becomes too low.

- Reallocate Treasury: Temporarily boost liquidity or cover operational shortfalls to ensure consistent platform performance.

This proactive approach ensures that Palladium remains resilient and adaptable in the face of unforeseen challenges.

Transparency Tools: Ensuring Accountability and Trust

Transactions Analytics

All token movements—including initial distribution, vesting unlocks, and buybacks—are trackable via block explorers or CEX statetaments, ensuring full transparency. Stakeholders can independently verify token flows and allocations at any time.

Public Audits

Periodic audits of smart contracts, treasury accounts, and property valuations are conducted to verify that reported data aligns with actual figures. These audits are made publicly available to maintain trust and demonstrate commitment to integrity.

KPI Dashboards

Real-time performance metrics are provided to stakeholders through comprehensive KPI dashboards. Metrics include:

- Occupancy Rates: Monitoring property utilization and revenue generation.

- Renovation Progress: Tracking the status and success of property enhancements.

- Trading Returns: Evaluating the effectiveness of trading strategies.

- Token Price Movements: Analyzing market performance and investor sentiment.

These tools foster an environment of openness and accountability, ensuring that all stakeholders are informed and engaged.

Risk Factors: Comprehensive Listing

Market Volatility: Interest Rate Changes, Geopolitical Conflicts, Commodity Crises

Global factors beyond Palladium’s control can affect rental demands or trading opportunities. While diversification and hedging help, absolute immunity is impossible.

Regulatory Uncertainty: Changing Classifications, Caps on Foreign Ownership, New Tax Rules

As laws evolve, token classification or property investment caps may appear. Palladium monitors regulations and adapts promptly, yet policy shifts can incur costs or delays.

Technological Vulnerabilities: Smart Contract Bugs, Oracle Attacks, Hardware Failures

Despite audits and best practices, unforeseen bugs or exploits remain a non-zero risk. Rapid patching, contingency funds, and insurance mitigate impacts.

Liquidity and Redemption: Seasonal Demand, Market Illiquidity, Investor Exodus Under Panic

Some NFTs may prove less liquid if local market sentiment sours. Trading might slow if volumes shrink. Transparent redemption policies and stable reserves cushion these scenarios.

Force Majeure: Natural Disasters, Pandemics, Infrastructure Collapses

Unpredictable catastrophic events can disrupt property incomes or even destroy assets. Insurance, emergency funds, and geographical dispersion reduce vulnerability.

Investor Misunderstanding: Lack of Due Diligence, Overexposure, Ignoring Fundamentals

While Palladium educates, ultimately investors must act responsibly. Irresponsible leverage or herd mentality can cause personal losses. The platform encourages rational, informed participation.

Mitigations: Insurance, Contingency Funds, Hedging, Stress-Testing Protocols, Rapid Response Teams

Diverse mitigation tools exist: insurance for property damage, hedging for market swings, stress-tests guiding policy responses, and specialist teams trained to handle crises swiftly.

Encouraging Personal Responsibility: Diversification, Education, Professional Advice

Palladium reiterates: investors should diversify portfolios, educate themselves, and consult professionals. Well-informed participants collectively enhance the platform’s stability.

Regulatory, Compliance, and Security: The Triumvirate of Confidence

Legal Harmonization: Navigating Global Regulatory Landscapes

Palladium takes a proactive approach to legal compliance, aiming to establish itself as a trusted and legally recognized platform across multiple jurisdictions.

Securing Licenses in Financial Hubs

- Strategic Approvals: Palladium actively seeks licenses in major financial jurisdictions where tokenization laws are well-defined, such as the European Union (under MiCA), Singapore (MAS), and Australia (ASIC). This ensures compliance with local laws while expanding access to global markets.

- Regulatory Readiness: By aligning its operations with established frameworks like MiCA and FATF standards, Palladium demonstrates its commitment to maintaining high compliance standards in both developed and emerging markets.

Negotiating Safe Harbors

- Collaborative Engagement: Palladium engages in open dialogue with lawmakers and regulators to anticipate changes in tokenization laws, advocating for clear and supportive legal structures.

- Reducing Legal Uncertainty: By negotiating safe harbors, Palladium minimizes risks for investors and token holders, creating a secure environment for capital deployment.

Adapting to Regulatory Shifts

- Continuous Monitoring: A dedicated compliance team tracks global regulatory developments, ensuring Palladium remains adaptable and responsive to new laws and guidelines.

- Cross-Border Flexibility: Palladium structures its operations to accommodate multi-jurisdictional requirements, enabling seamless expansion into new markets while maintaining compliance.

Attracting Institutional Capital

- Trust and Recognition: By adhering to regulatory frameworks and securing licenses, Palladium builds credibility with institutional investors and financial partners.

- Investor Protection: Legal harmonization efforts ensure that investors’ rights are upheld, attracting serious capital from both retail and institutional participants.

Commitment to Legal Excellence

Palladium’s legal harmonization strategy positions the platform as a leader in compliant tokenization, paving the way for sustainable growth and global investor confidence. By proactively engaging with regulators and securing the necessary approvals, Palladium reduces uncertainty, fosters trust, and creates a robust framework for long-term success.

AML/KYC Rigor: Enhanced Due Diligence, Ongoing Monitoring, Whitelisting Strategies

Adhering to robust Anti-Money Laundering (AML) and Know Your Customer (KYC) standards is vital for sustaining a reputable, compliant ecosystem. By enforcing these measures, we not only protect the project’s integrity but also foster trust among legitimate participants. Below is an overview of our multi-layered approach to AML/KYC:

Enhanced Due Diligence (EDD)

- High-Value Checks: Investors and participants exceeding specific thresholds undergo more stringent identification requirements, including verifiable proof of source of funds.

- Identity Verification: We collaborate with reputable third-party KYC providers to validate government-issued IDs, cross-reference watchlists, and confirm participants’ identities.

Ongoing Monitoring

- Transaction Pattern Analysis: All wallet activities are continuously scrutinized for irregularities. Automated systems help detect spikes in transaction volume, suspicious fund flows, or rapid large transfers that may indicate money laundering or other illicit behaviors.

- Periodic Reverification: Users may be required to re-complete KYC steps if their activity or risk profile changes significantly over time, ensuring data remains accurate and up to date.

- Incident Reporting: Any anomaly is escalated to a dedicated compliance team for immediate investigation. Where necessary, suspicious wallet addresses may be flagged or suspended pending further review.

Independent Audits: Comprehensive Financial and Operational Verification

Palladium is committed to maintaining transparency and trust by engaging in the future with reputable third-party auditing firms to conduct thorough reviews across all critical aspects of the ecosystem. These independent audits provide investors with confidence that all operations are accurate, transparent, and aligned with Palladium’s commitments.

- Financial Audits: Annual reviews conducted by established accounting firms verify rental income streams, property-related earnings, ensuring complete financial accuracy and accountability.

- Property Valuations: Certified property experts evaluate real estate holdings, ensuring that asset valuations reflect current market conditions and align with investor expectations.

- Smart Contract Audits: Experienced code auditors rigorously examine the smart contracts governing PLLD tokens, NFT transactions, and trading operations to ensure security, functionality, and compliance with best practices.

By incorporating multiple layers of professional scrutiny, Palladium reinforces its commitment to reliability and establishes a foundation of trust that ensures all claims are backed by verifiable data and processes.

Aligning with Global Standards: Building a Cross-Border Compliance Framework

Palladium is actively engaging with regulatory authorities and legal advisors to align its operations with globally recognized frameworks. The project is currently in discussions to secure compliance in key jurisdictions and is implementing measures to meet international standards. By proactively working toward full alignment with regulations such as MiCA, AML/KYC directives, and ESG benchmarks, Palladium aims to establish trust, attract institutional investors, and lay the foundation for long-term success.

Key Regulatory Frameworks

-

European ESMA Directives and MiCA Compliance: The project adheres to the European Securities and Markets Authority's directives and the Markets in Crypto-Assets Regulation (MiCA). This includes transparent whitepaper disclosures, clear operational structures, and anti-money laundering (AML) compliance, ensuring trust within the European Union's investor ecosystem.

-

U.S. SEC Guidelines: Palladium ensures that token offerings and operations align with the U.S. Securities and Exchange Commission's (SEC) standards, preparing the project to address potential classifications as securities while fostering investor confidence in the U.S. market.

-

Singapore MAS Standards: Palladium aligns with the Monetary Authority of Singapore's (MAS) licensing and operational requirements for digital tokens, enabling access to one of the world’s leading financial hubs and its crypto-friendly ecosystem.

-

Australian ASIC Regulations: The project aligns with the Monetary Authority of Australian Securities and Investments Commission's guidelines for crypto-assets, enhancing transparency and investor protection within the Australian market.

-

FATF AML Standards: Implementing the Financial Action Task Force’s anti-money laundering (AML) and counter-terrorist financing (CTF) guidelines ensures Palladium operates within global financial crime prevention standards. This includes robust KYC protocols and transaction monitoring.

Practical Steps for Alignment

-

Whitepaper Compliance: Palladium provides a comprehensive whitepaper that meets the disclosure requirements of MiCA and other major regulatory frameworks, detailing token functionality, risks, and operational structures.

-

KYC and AML Integration: A robust system for customer due diligence ensures compliance with FATF and jurisdiction-specific AML laws, fostering a secure and transparent ecosystem.

-

Legal Counsel: Experienced legal advisors ensure that operations remain compliant across key markets, from the U.S. and EU to Singapore and Australia.

Investor Protections: Clear Dispute Resolution, Transparent Terms of Service, and Known Redemption Paths

Palladium ensures user confidence and operational transparency by detailed terms of service agreement. These terms are designed to provide clarity on user rights, income entitlements, and dispute resolution, offering a straightforward and accessible framework for all participants.

Terms of Service: Guaranteeing Rights and Transparency

The terms of service clearly outline user rights, obligations, and entitlements, ensuring there is no ambiguity about what users can expect. Key points include:

- Rights to participate buybacks.

- Entitlements to income from trading profits or property-based NFT returns thru token buybacks.

- Responsibilities for adhering to platform policies.

Guaranteed Income Rights

Specific provisions within the terms of service secure users’ access to profits from buybacks. For NFT holders, entitlements to property-based income streams and asset appreciation are clearly defined, guaranteeing predictable and transparent participation.

Dispute Resolution Framework

- Regional Arbitration Options: For global investors, disputes can be resolved in jurisdictions that align with the platform’s operational hubs, ensuring accessibility and neutrality.

- Escalation Procedures: Structured paths for escalating conflicts ensure that investors’ concerns are addressed promptly and effectively.

Known Redemption Paths

- Buyback Processes: Investors benefit from transparent and scheduled token buybacks, ensuring predictable paths to liquidity.

- NFT Liquidity Options: Property-backed NFTs can be sold on the Palladium marketplace, offering holders flexibility to redeem their investments in line with asset appreciation and income streams.

- Exit Strategies: Well-defined redemption mechanisms allow investors to liquidate holdings confidently, without unnecessary delays or hidden complexities.

Empowering Investor Confidence

By reducing uncertainty and ensuring recourse through clearly defined agreements and processes, Palladium empowers investors to commit capital confidently. These protections not only align with global best practices but also reinforce Palladium’s commitment to transparency, fairness, and trust.

Cybersecurity: Multi-Layered Defense, Ethical Oversight, and Continuous Protection

Palladium places security at the forefront of its operations, employing a comprehensive cybersecurity strategy to safeguard assets, user data, and system integrity. By integrating industry-leading practices, the platform minimizes risks and ensures a robust defense against evolving cyber threats.

Defense-In-Depth Approach

- Layered Security: A multi-tiered defense strategy ensures that even if one layer is compromised, subsequent layers provide continued protection. This approach integrates network security, application safeguards, and endpoint protection.

- Zero-Trust Architecture: Systems operate on the principle of "never trust, always verify." This ensures that access to data and resources is tightly controlled, limiting potential damage from breaches or unauthorized access.

Proactive Vulnerability Management

- Regular Penetration Testing: Certified security professionals conduct routine pentests to simulate potential attacks, uncover vulnerabilities, and recommend corrective measures.

- Bug Bounty Programs: Ethical hackers are incentivized to identify and report security flaws, leveraging external expertise to bolster system integrity.

- Continuous Monitoring: Advanced threat detection systems provide real-time insights, enabling rapid identification and mitigation of cyber threats.

Data Protection and Breach Containment

- Partitioned Systems: Zero-trust networking ensures that systems are segmented, containing potential breaches and preventing lateral movement across the network.

- Encryption Standards: All sensitive data is encrypted both in transit and at rest, safeguarding user information against unauthorized access.

- Incident Response Plans: Well-defined protocols ensure that any security incidents are addressed swiftly and effectively, minimizing potential impact.

Commitment to Security Excellence

By combining proactive measures, ethical oversight, and state-of-the-art technologies, Palladium establishes itself as a trusted platform. This unwavering focus on cybersecurity not only protects the ecosystem but also reinforces confidence among investors and participants.

Operational Resilience: Disaster Recovery, Backup Facilities, and Fail-Safe Mechanisms

Palladium is committed to maintaining uninterrupted operations and safeguarding investor interests, even during unforeseen disruptions. By implementing a robust operational resilience framework, the platform ensures continuity, security, and integrity under all circumstances.

Redundant Infrastructure

- Backup Facilities: Multiple geographically distributed data centers safeguard critical operations, ensuring that Palladium can quickly recover from localized outages or disasters.

- Automated Backups: Regular, automated backups of all essential data and systems minimize the risk of data loss and enable rapid restoration.

Disaster Recovery Plans

- Market Anomaly Detection: Advanced monitoring systems identify severe market anomalies, such as flash crashes or liquidity collapses, triggering automatic responses.

- Trading Halts: Fail-safe mechanisms allow for the suspension of trading activities to preserve treasury integrity and prevent unfavorable trades during bad market conditions.

Operational Strategy and Market Growth: From Blueprint to Execution

Acquisition Pipelines: Local Expertise, Macro Forecasting, Infrastructure Project Tracking

Property scouts leverage local networks, researching demographic flows, infrastructure upgrades, and urban revitalization projects. Macro forecasting tools predict which cities will thrive under evolving conditions, guiding long-term acquisitions aligned with stability and growth.

Infrastructure Enhancement: Option-Based Trading, Stablecoin Carry Trades, Funding Rate Plays

As cryptocurrency markets mature, trading opportunities expand. Beyond spot disparities, the engine pursues option mispricings, stablecoin yield differentials, and funding rate arbitrage on perpetual swaps. Diversifying trading tactics reduces correlation to a single market dynamic.

Scalable Onboarding: Automated KYC, Self-Help Tools, AI Chat Interfaces for Investor Queries

To handle large user inflows, Palladium streamlines onboarding. Automated KYC solutions speed compliance checks, self-help knowledge bases answer common questions, and AI chatbots guide investors through arbitrage, NFT purchases, or understanding fee structures.

Branding: Universal Reputation for Reliability, Prudence, Ethical Management

Public interviews with executives, participation in policy dialogues, and co-sponsoring industry conferences shape Palladium’s brand as a trustworthy innovator. Over time, familiarity and consistent performance forge a recognizable identity synonymous with quality and responsibility.

Expertise at the Helm: Multi-Disciplinary Teams Merging Real Estate, Finance, Tech, Compliance

Recruiting top talent from diverse fields ensures balanced decision-making. Real estate veterans assess property potential, financial quants refine trading formulas, compliance officers manage legal complexities, and engineers build secure, scalable infrastructures. Collective intelligence fosters robustness.

Data Partnerships: Property Intelligence, Tenant Screening Databases, ESG Rating Agencies

Securing partnerships with data vendors enhances decision-making. Tenant screening reduces default risk, property intelligence platforms identify undervalued niches, and ESG rating agencies verify sustainability claims. Data-driven insights minimize blind spots and refine strategic goals.

Organizational Scalability: Hierarchies with KPIs, Performance Reviews, Continuous Improvement Loops

As operations broaden, Palladium adopts structured hierarchies, measurable KPIs, and periodic performance appraisals to ensure cohesive and sustainable growth. Key strategies include:

-

Defined KPIs for All Teams Each department—real estate management, Trading operations, compliance, and tech development—operates with clear, measurable objectives tied to quarterly or annual goals.

-

Performance Reviews and Training Modules Regular appraisals identify high-performing team members and areas needing improvement, while tailored training programs enhance skills and ensure alignment with strategic objectives.

-

Continuous Improvement Loops Proactive feedback mechanisms detect inefficiencies early, enabling swift adjustments to processes, workflows, or technologies. These loops maintain Palladium’s nimbleness despite increasing complexity.

-

Governance Approach Palladium balances a traditional corporate governance model with decentralized community input:

- Traditional Board Oversight: A leadership team ensures accountability, strategic direction, and legal compliance.

- Community Engagement: Chain-based voting mechanisms allow PLLD token holders to participate in select decisions, such as resource allocation or ESG initiatives. This hybrid approach aligns centralized efficiency with decentralized inclusivity.

-

Scalable Hiring Framework As Palladium grows, hiring is prioritized for roles that strengthen operational resilience, such as compliance officers, property managers, and blockchain developers. Cross-functional onboarding ensures new hires can integrate seamlessly into existing teams.

Alliances with Sustainable Developers, Architects, Urban Planners for Long-Term Positive Impact

Beyond pure finance, Palladium aligns with firms dedicated to environmental design, community building, and urban renewal. These alliances enhance property values, attract conscientious tenants, and yield moral dividends—resonating with ESG-oriented investors.

Short-Term (0–6 Months): Automated Trading Expansion, Buybacks, and Foundational Preparations

Automated Trading Expansion

- Increasing Market Reach: Focus on expanding automated trading operations to more centralized exchanges (CEXs), decentralized exchanges (DEXs), and OTC platforms. By broadening market coverage, the platform will identify more price discrepancies, enhancing overall profit potential.

- Maximizing Efficiency: Initial efforts will prioritize straightforward market inefficiencies while refining automated trading algorithms to optimize returns. This phase is crucial for building a consistent and profitable track record.

Buybacks

- Profit-Driven Buybacks: Buybacks will be conducted based on profits achieved from trading operations. Funds raised during the initial funding phase will support automated trading performance, ensuring alignment with investor expectations.

- Randomized Timing: Buybacks will occur at random intervals to prevent market manipulation and minimize the risk of front-running.

- Quarterly Transparency Reports: Every three months, detailed reports will disclose buyback amounts and transaction details, fostering trust and transparency within the community.

Independent Audits & Compliance

- Technical Audits: Engage third-party auditors to review smart contracts, financial flows, and security practices.

- Regulatory Review: Ensure basic compliance frameworks are in place for anticipated expansions in the coming months.

Medium-Term (6–12 Months): Swap Implementation, Advanced Automated Trading Algorithms, Comprehensive Real Estate Diligence

- Swap Implementation

- Introducing PLLD Swap: Enable trading within the PLLD ecosystem by launching a user-friendly, Web3-integrated swapping platform. This feature will streamline liquidity management, allowing users to securely trade PLLD tokens and other supported cryptocurrencies across multiple blockchain networks.

-

Advanced Trading Instruments

- Futures & Options: Introduce more sophisticated tools to diversify revenue streams and hedge risks effectively.

- Expanded Markets: Explore liquidity in emerging markets, if aligned with compliance regulations.

-

Comprehensive Real Estate Due Diligence

- Legal Consultations: Work closely with legal teams to structure property tokenization models and assess cross-border requirements.

- Market & Property Research: Conduct on-ground or virtual due diligence, refining a shortlist of properties that show high profit potential.

- Community Engagement: Gather preliminary feedback on regions or property types of greatest interest to tokenholders.

-

Drafting Real Estate Agenda

- End-of-Phase Deliverable: By the close of the 12th month, publish a list of potential properties the project can realistically tokenize, backed by lawyer opinions and market analysis.

Real Estate Agenda Launch (End of 12 Months): Community Feedback & Finalization

-

Public Presentation of Property Shortlist

- Transparency: Share in-depth details (location, cost, projected ROI, risk factors) for each candidate property.

- Legal & Structural Proposals: Outline how each property could be integrated into tokenization (e.g., SPVs, REIT-like structures, or direct ownership models).

-

Community & Investor Input

- Voting & Surveys: Solicit tokenholder preferences on which properties to prioritize.

- Final Selection: Combine community sentiment, lawyer recommendations, and financial viability to finalize the initial acquisitions queue.

-

Transition to Tokenization

- Funding Allocation: Confirm budget and timelines for acquisitions.

- Tokenization Prep: Finalize smart contract architecture, compliance checks, and escrow arrangements.

Long-Term (12+ Months): Tokenization Rollout, Geographic Diversification

-

Tokenization & Distribution

- Regulatory Compliance: Register or formalize the tokenization process in line with applicable laws.

- Investor Accessibility: Offer fractional ownership or real-estate-backed tokens to participants, diversifying the ecosystem’s offering.

-

Property Renovations

- Value Add: Where relevant, undertake renovations or operational improvements to enhance ROI.

-

Geographic & Portfolio Expansion

- New Markets: Evaluate expansion into additional continents or higher-growth regions, subject to legal feasibility and risk appetite.

- Selective ESG Inclusion: While not committing to formal ESG certification, incorporate select high-potential properties that also align with certain sustainability or social criteria, as warranted.

-

AI-Powered Trading & Ongoing Improvements

- Adaptive Strategies: Integrate AI-driven algorithmic tools to refine real-time trading decisions.

- Continuous Feedback Loop: Update tokenholders on performance and future tokenization possibilities.

Comparisons and Benchmarks: Contextualizing Palladium’s Value

Palladium vs. REITs: Fractionalization, 24/7 Trading, Crypto Interoperability, Automated Trading Enhancements

REITs modernized property investing but remain regionally limited, trade only during business hours, and lack crypto’s flexibility. Palladium will offer fractional ownership with global reach, continuous trading, and automated-trading-driven yields, surpassing REIT constraints.

Palladium vs. Pure Crypto Protocols: Tangible Asset Anchors, Reduced Speculation, Rationalized Returns

Most crypto yield platforms rely on token emissions or speculative demand. Palladium grounds its token in actual property income and trading efficiency, producing stable, fundamentally backed returns less swayed by market hype cycles.

Palladium vs. Other Tokenization Platforms: Integrated Algorithmic Trading as a Unique Advantage, ESG Alignment

Some platforms tokenize real estate but fail to integrate trading-driven buybacks or embrace stringent ESG criteria. Palladium’s engine will offsets volatility and its ESG stance resonates with conscientious capital, offering a more holistic, future-ready solution.

KPIs: NOI Growth, Occupancy Rates, Trading Strike Rates, Token Volatility Reduction, ESG Scores

We will measure success not only by token price but also by NOI growth, stable occupancy, trading consistency, reduced token volatility. These metrics provide a 360-degree view of progress and resilience.

Academic and Institutional Endorsements: Validation from Economists, BIS, IMF, WEF Studies

Whitepapers from authoritative institutions indicate that linking digital assets to real productivity improves stability. Economist endorsements, BIS/IMF research, and WEF reports on tokenization’s potential all validate Palladium’s underlying logic.

Longitudinal Analysis: Assessing Multi-Year Performance Against Real Estate and DeFi Indexes

Over years, we compare Palladium’s yields to global property indexes and DeFi benchmarks. If Palladium consistently outperforms on risk-adjusted bases, it builds a track record that invites even more capital and cements its role as a safe harbor.

ESG and Impact Comparisons: Outperforming Traditional Funds in Sustainability and Social Good Metrics

ESG scoring frameworks assess energy usage, supply chain ethics, tenant well-being, and corporate governance. Palladium aims to exceed traditional real estate funds in these metrics, appealing to capital that mandates ethical deployments.

Presentation & Accessibility: Communicating Complexity Elegantly

Tiered Documentation: Whitepapers, Technical Papers, Investor Guides, Scholarly Articles

We produce layered content. The core whitepaper provides holistic overviews, technical papers detail code and algorithmic trading math, investor guides simplify onboarding, and scholarly articles explore theoretical implications, appealing to diverse audiences.

Infographics, Animations, Virtual Property Tours: Bridging Abstract Concepts with Tangible Imagery

Visually representing property data, trading flows and token distributions helps investors quickly grasp complex dynamics. Virtual property tours humanize the assets, showing them as lived-in spaces with real human significance.

Targeted Messaging: Institutional Briefings, Retail FAQs, NGO Partnerships for Social Projects

Institutional decks highlight compliance, stability, and market integration. Retail FAQs break down jargon. Partnerships with NGOs frame Palladium’s initiatives in terms of social betterment, attracting mission-driven stakeholders.

Academic Alliances: Research Partnerships, Conferences, Publications in Peer-Reviewed Journals

Collaborations with universities and think tanks produce rigorous studies, increasing credibility. Participating in academic conferences and publishing peer-reviewed research cements Palladium’s status as an intellectual leader, not just a market participant.

Inclusive Design: Multi-Language Support, Accessibility Tools, Cultural Sensitivity in Communication

Ensuring documentation is accessible to visually impaired readers, providing multi-language content, and respecting cultural differences expand the platform’s global reach. This inclusivity aligns with Palladium’s universalizing vision.

Engaging Traditional Firms: Private Workshops, Custom Reporting, Integration with Portfolio Management Systems

For established wealth managers, Palladium offers custom reporting formats, integration APIs for their portfolio tools, and private workshops that demonstrate how to blend crypto-backed real estate into existing allocation models.

Public Seminars, Webinars, Podcasts: Educating the Wider Public, Encouraging Debate and Feedback

Events like seminars and podcasts demystify tokenization, automated trading, and ESG alignment for the general public. Open debate fosters trust, and critical feedback guides continuous refinement.

Case Studies & Scenarios: Immersive Practical Examples

The following scenarios are illustrative only and designed to showcase the potential applications of Palladium's ecosystem. Real-world opportunities may differ depending on local regulations, market conditions, and operational logistics.

Prague Residential Portfolio: Multi-Year Yield Stability, Tenant Well-Being, Cultural Value Preservation

In Prague, a historically stable rental market and thriving tourism support steady rental yields. By tokenizing apartments in culturally rich neighborhoods, Palladium provides consistent monthly income to NFT holders. Over time, improvements—like energy-efficient refurbishments—boost tenant satisfaction and reinforce long-term occupancy.

Berlin Renovation Series: Documenting Impact on Communities, Architectural Heritage, Employment Generation

Acquiring aging Berlin flats and renovating them increases property value, modernizes living standards, and respects architectural heritage. Investors see capital appreciation upon resale, while local communities benefit from improved housing, job creation in construction trades, and preservation of urban identity.

Arbitrage Under Flash Crashes: Monetizing Mispricings, Injecting Rationality into Panicked Markets

During a sudden crypto crash—perhaps triggered by unexpected regulatory news—prices dislocate. Palladium’s arbitrage engine quickly identifies gross mispricings. By executing rapid trades, it profits from these gaps, partially stabilizing the market and reducing panic-driven swings, indirectly benefiting all participants.

Bear Market Strategies: Defensive Trading, Quality Asset Emphasis, Derivative Hedges

In a prolonged bear market, Palladium pivots to defensive trading mode, focusing on safer property sectors (like essential residential units). Derivative hedges guard against further downside. Although returns may dip, the platform remains profitable and resilient, preserving investor confidence.

Cross-Chain Arbitrage: Equalizing Liquidity, Encouraging Interoperability, Spreading Rational Price Signals

As liquidity fragments across multiple blockchains, Palladium’s engine arbitrates between chains, promoting uniform pricing. By doing so, it reduces fragmentation, fosters interoperability, and encourages other participants to view cross-chain commerce as integrated rather than disjointed.

ESG Properties: Nordic Sustainable Apartments, Energy Savings, Tenant Satisfaction Surveys

Investing in energy-efficient Nordic residences yields stable occupancy (as eco-conscious tenants value sustainability), potential carbon credit opportunities, and reduced overhead costs. ESG reports highlight fewer greenhouse emissions, positive tenant feedback, and higher investor satisfaction from mission-aligned returns.

Thematic Bundles: Tech-Hub Offices, Senior Housing, Sustainable Agriculture—Crafting Specialized Risk-Return Profiles

By curating thematic property bundles (e.g., senior housing catering to aging demographics), Palladium lets investors tailor exposures to specific economic narratives. Tech-hub offices capture innovation hubs, sustainable agriculture land hedges against food inflation, and socially oriented portfolios resonate with impact-driven capital.

Beverly Hills Estates: Celebrity Appeal and Unmatched Exclusivity

- Overview: Surrounded by iconic Hollywood landmarks, Beverly Hills boasts ultra-high-value homes, many historically owned by celebrities or business magnates. Tokenizing these estates gives investors fractional stakes in iconic neighborhoods known for prestige and cultural cachet.

- Investor Potential:

- Global Recognition: Easy to market thanks to Hollywood’s worldwide appeal.

- Resilience: Prime LA real estate often retains value during downturns.

- Community & Cultural Impact:

- Local Heritage: Preservation of architectural gems, some carrying historic significance.

- Tourism Boost: High-profile addresses draw luxury tourism, benefiting local businesses.

Monaco Waterfront Residences: Mediterranean Glamour and Elite Yachting Culture

- Overview: Monaco’s waterfront developments cater to the yachting elite, with private marinas and waterfront promenades. Tokenizing select properties along Port Hercule allows fractional access to one of the world’s most exclusive zip codes.

- Investor Potential:

- High Liquidity for Luxury: International buyers frequently seek property in Monaco due to tax advantages and glamor.

- Prestigious Community: Neighbors include global celebrities, F1 enthusiasts, and billionaire entrepreneurs.

- Strategic Considerations:

- Space Constraints: Limited land supply often leads to sky-high real estate prices.

- Regulatory Nuances: Strict local laws require careful structuring of fractional ownership.

Aspen Ski Resort Chalets: Winter-Season High-End Rentals and Year-Round Escapes

- Overview: Aspen, Colorado, is a famed luxury ski destination. Tokenized chalets or condos near top ski slopes draw premium rents in winter and steady occupancy for summer mountain retreats.

- Investor Potential:

- Seasonal Rental Premiums: Wealthy tourists pay top dollar for prime ski-in/ski-out chalets.

- Eco-Tourism Upside: Outdoor enthusiasts visit year-round, diversifying rental income.

- Community & Sustainability:

- Environmental Stewardship: Encourages energy-efficient renovations in ecologically sensitive mountain regions.

- Local Economy: Seasonal employment for chalet services, ski instructors, and hospitality staff.

Maldives Private Island Resorts: Ultra-Luxury Tourism in a Climate-Vulnerable Paradise

- Overview: The Maldives’ private islands host some of the world’s most expensive resort villas. Tokenizing partial ownership of these exclusive retreats opens a niche for high-net-worth individuals wanting exposure to lavish oceanfront getaways.

- Investor Potential:

- High Daily Rates: Honeymooners and luxury vacationers pay premium prices for overwater bungalows and private beaches.

- Brand Partnerships: Potential tie-ins with five-star hotel chains or global travel agencies.

- Sustainability & Risks:

- Climate Adaptation: Rising sea levels demand investments in eco-friendly infrastructure.

- Eco-Tourism: Emphasizing marine conservation, reef protection, and green energy elevates brand appeal and mitigates environmental impact.

Paris Haute Couture Boulevard: Fashion-Forward Mixed-Use Properties

- Overview: In Paris’s legendary fashion districts—like Avenue Montaigne or Rue Saint-Honoré—tokenized buildings can combine luxury retail, upper-floor residences, and showrooms for haute couture brands.

- Investor Potential:

- High-End Retail Leases: Global fashion houses regularly pay a premium for flagship locations.

- Event Monetization: Hosting runway shows, designer pop-ups, and exclusive events generates additional income.

- Cultural & Economic Impact:

- Conservation of Historic Architecture: Older Parisian façades require respectful restoration, preserving UNESCO-like heritage.

- Luxury Tourism: Paris’ status as a global fashion capital supports year-round foot traffic and tourist spending.

Swiss Alpine Retreats: Wellness Spas and Luxury Eco-Chalets

- Overview: Switzerland’s alpine villages attract affluent visitors seeking health retreats, winter sports, and pristine natural scenery. Tokenizing exclusive spa resorts and eco-chalets capitalizes on the region’s high spending power.

- Investor Potential:

- Premium Wellness Market: Spa treatments, organic cuisine, and scenic views command top-tier room rates.

- Global Accessibility: Well-connected airports and efficient trains facilitate year-round tourism.

- Sustainability Angle:

- Eco-Friendly Construction: Favoring wooden chalets, geothermal heating, and solar energy.

- Alpine Preservation: Strict local regulations protect landscapes, preserving long-term value and limiting development overload.

Singapore Orchard Road Luxury Offices & Retail: Urban Core Prestige

- Overview: Orchard Road is Singapore’s premier shopping and business district, mixing upscale malls with Class-A office towers. Tokenizing these properties blends stable commercial leases with high-end retail foot traffic.

- Investor Potential:

- Corporate Demand: Global tech firms and financial institutions lease prime offices in Singapore, ensuring stable occupancy.

- Retail Synergy: Luxury department stores, flagship apparel brands, and top-tier restaurants support consistent footfall.

- Governance & Urban Appeal:

- Regulatory Ease: Singapore’s business-friendly environment eases cross-border investment but requires compliance with well-defined local statutes.

- Long-Term Growth: The city-state’s robust economy and strategic location in Asia make it a magnet for global capital and skilled professionals.

Future Outlook & Sustainability: Envisioning Decades Ahead

Redefining Global Economic Fabric: A Stable, Inclusive, and Ethically Aligned Financial Paradigm

Palladium aspires to help rebuild trust in finance by blending DeFi’s efficiency with real asset grounding. Over decades, as more capital flows into stable, ethically managed tokens, global markets could shift toward measured growth, reduced booms and busts, and broader prosperity.

Regulatory Harmonization: Influencing Policy, Setting Benchmarks, Lobbying for Balanced Frameworks

By collaborating with regulators, presenting empirical results, and emphasizing investor safeguards, Palladium contributes to balanced policy frameworks. These efforts shape global best practices, encouraging other projects to follow similar compliance and ethical standards.

Scaling Across Continents: Reflecting Global GDP Patterns, Balancing Developed and Frontier Markets

Envision a portfolio spanning from European cultural capitals to fast-growing Southeast Asian cities, African innovation corridors, and Latin American tourist hotspots. This worldwide tapestry mitigates localized risks and captures diverse growth engines, benefiting from globalization’s complexity.

Deepening ESG Integration: Carbon Neutrality Targets, Social Impact Commitments, Corporate Governance Reforms

Palladium recognizes the growing importance of Environmental, Social, and Governance (ESG) considerations in the investment landscape. While we do not commit to specific outcomes at this stage, we are actively exploring strategies to integrate ESG principles into our operations wherever feasible.

Technological Roadmap: Quantum-Resistant Cryptography, AI Macro Trend Prediction, Automated Renovation Analytics

Tomorrow’s tech includes quantum-resistant keys to secure holdings against future computational leaps. AI macro trend predictors foresee demographic and policy shifts, guiding strategic pivots. Automated renovation analytics propose improvements for each property, enhancing value generation with minimal manual input.

Government and Corporate Partnerships: Public-Private Collaborations, Smart City Deployments, Affordable Housing Programs

Partnerships with municipalities to revitalize neighborhoods, corporate leasing deals providing stable long-term tenants, and NGO collaborations for affordable housing place Palladium at the heart of solving societal challenges. This expands its mission beyond finance to social engineering for good.

Macro-Level Impact on Crypto Stability: Reducing Volatility, Encouraging Institutional Allocations, Elevating Crypto’s Global Standing

If a significant share of crypto liquidity roots in stable assets and rational arbitrage, volatility diminishes. Lower volatility lures institutions—pension funds, endowments, insurance companies—that once avoided crypto’s wild gyrations. Palladium’s model thus fosters mainstream adoption and acceptance.

Shaping a Trust Brand: Palladium as the Standard for Ethical, Intelligent, Asset-Backed Finance

As track records build, Palladium’s brand becomes a beacon: investors know that tokens here are grounded, markets are rational, operations are ethical. Competitors might replicate elements, but Palladium’s early leadership cements its image as a pioneer and trustee of a noble vision.

Long-Term Vision: A Post-Volatility World Where Capital Reflects Productivity, Ethics, and Universal Opportunity

The ultimate dream: financial markets no longer oscillate wildly on rumors, but reflect real-world productivity, social priorities, and sustainable growth. Palladium’s legacy would be to have nudged markets toward sanity, ethics, and inclusion, leaving future generations with a more just economic order.

Communication & Reporting Frequency: Continuous Dialogue

Daily Market Updates: Crypto and Real Estate Trends