Palladium Network Litepaper

Version 1.2 | November 2025

Abstract

We propose Palladium, a hybrid system that merges real-estate–backed NFTs with an automated trading engine to offer stable returns and reduced volatility in digital markets. By tokenizing select properties and channeling a portion of trading profits into buybacks of Palladium’s native token (PLLD), the platform provides both tangible asset security and liquidity advantages. This litepaper outlines the tokenization models, buyback mechanism, vesting schedules, and the architectural foundations designed to democratize premium real estate ownership while incentivizing rational market behavior.

Introduction

Cryptocurrency markets have revolutionized finance but often suffer from extreme speculation and volatility. Real estate, conversely, provides consistent returns yet is traditionally illiquid and regionally bound. Palladium fuses these domains: fractionalized, globally accessible property ownership (via NFTs) is paired with automated high-frequency trading to drive ongoing revenue, support the PLLD token price, and stabilize the ecosystem.

Motivation

- Anchored Value: Rental income and property appreciation link a portion of the token’s worth to real-world productivity.

- Liquidity & Accessibility: Fractional NFTs reduce large capital requirements and open prime real estate to broader, international participation.

- Market Efficiency: Automated trading mitigates price distortions on cryptocurrency exchanges, fostering consistent buybacks and token support.

Real Estate Tokenization

Palladium’s Real Estate NFTs convert carefully selected real-world assets into fractional ownership tokens:

-

Selection & Due Diligence Properties undergo legal, environmental, and financial assessments. Only high-quality assets enter the portfolio to ensure reliability of rental and resale income.

-

Fractional Ownership NFTs represent proportional stakes in each property. Holders receive direct exposure to rental yields and potential value appreciation.

-

Legal Structuring Assets reside in Special Purpose Vehicles (SPVs) to maintain clear titles, separate liabilities, and ensure compliance with local property laws.

Trading Engine

Over the years, Palladium’s trading infrastructure has incorporated a wide spectrum of automated trading strategies designed to adapt to shifting market conditions. Arbitrage remains one of the core pillars of this ecosystem—serving as a stable, low-risk strategy that complements more advanced techniques while consistently contributing to the platform’s overall performance.

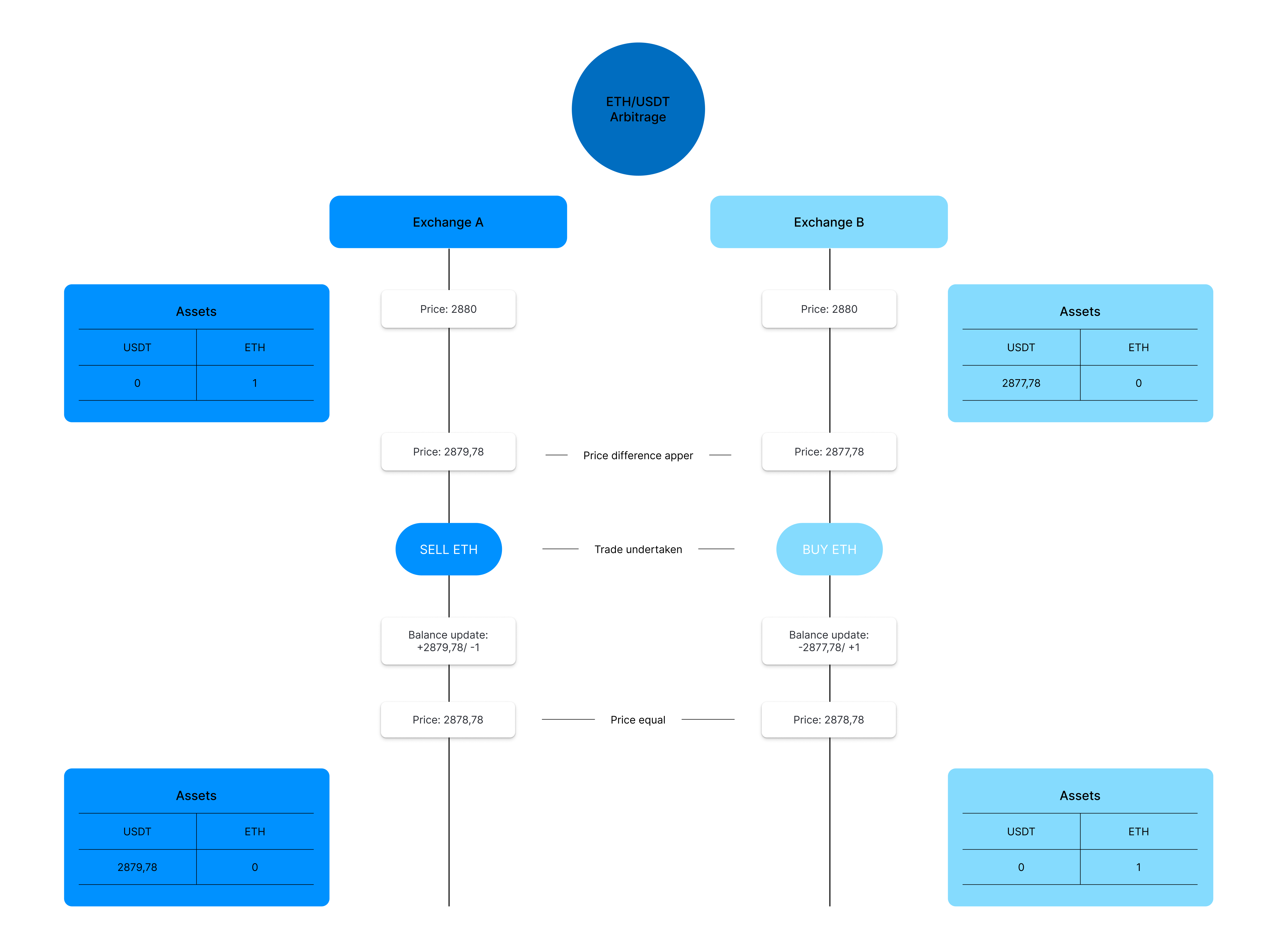

Standard Arbitrage

Palladium’s engine scans centralized and decentralized exchanges to identify short-lived price gaps. The system executes rapid buy-sell trades, exploiting these discrepancies for near risk-free profits. Revenues flow back into the treasury to fund future buybacks.

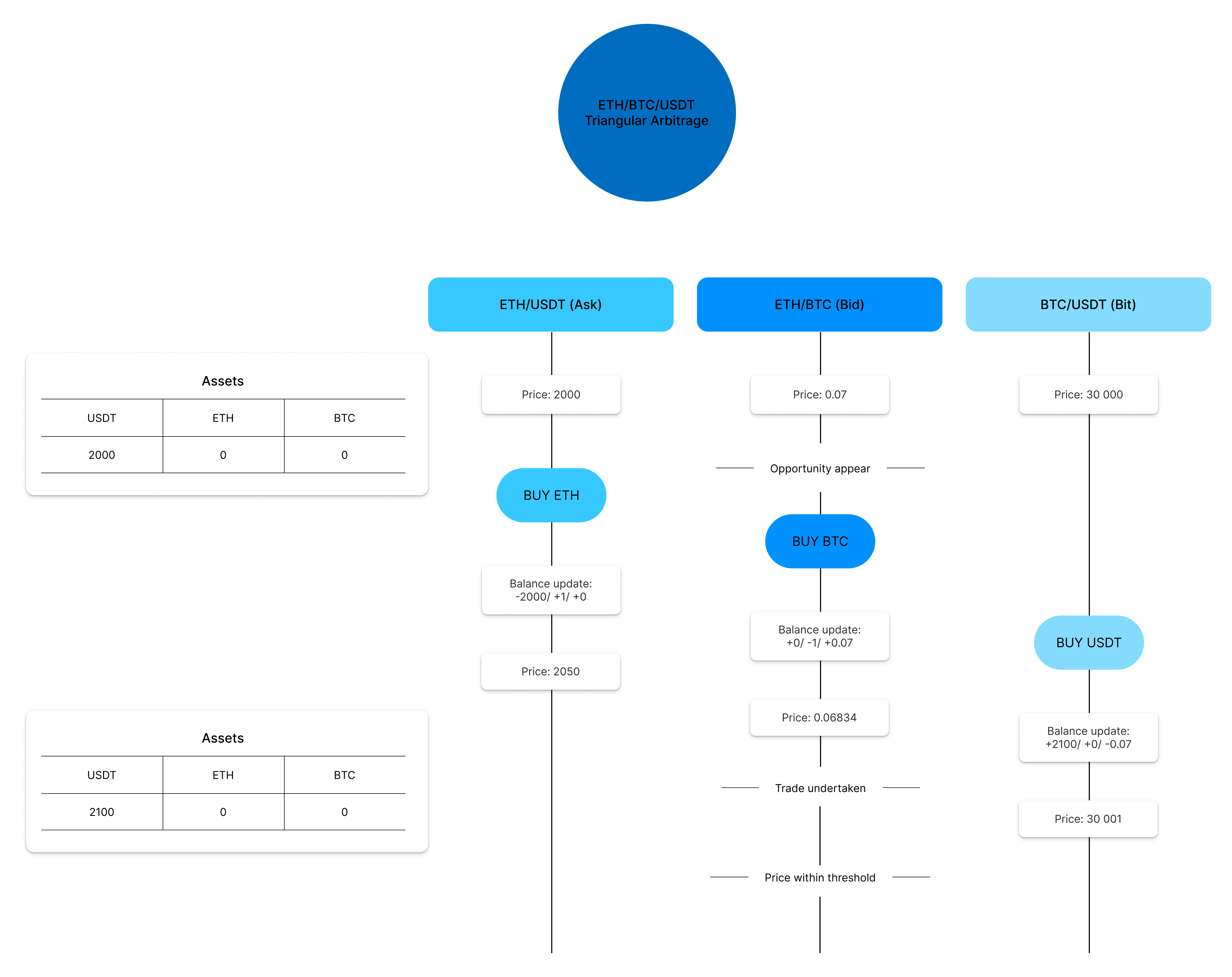

Triangular Arbitrage

By detecting small misalignments among three trading pairs—such as ETH, BTC, and USDT—the engine captures additional profits. This strategy broadens revenue sources and fosters tighter price integration across diverse exchanges.

Benefits

- Reduced Volatility: Frequent arbitrage dampens extreme market swings.

- Market Rationalization: Narrower spreads enhance overall liquidity and stability.

- Stable Returns: Arbitrage gains provide ongoing, performance-based funding for the Palladium ecosystem.

Tokenomics

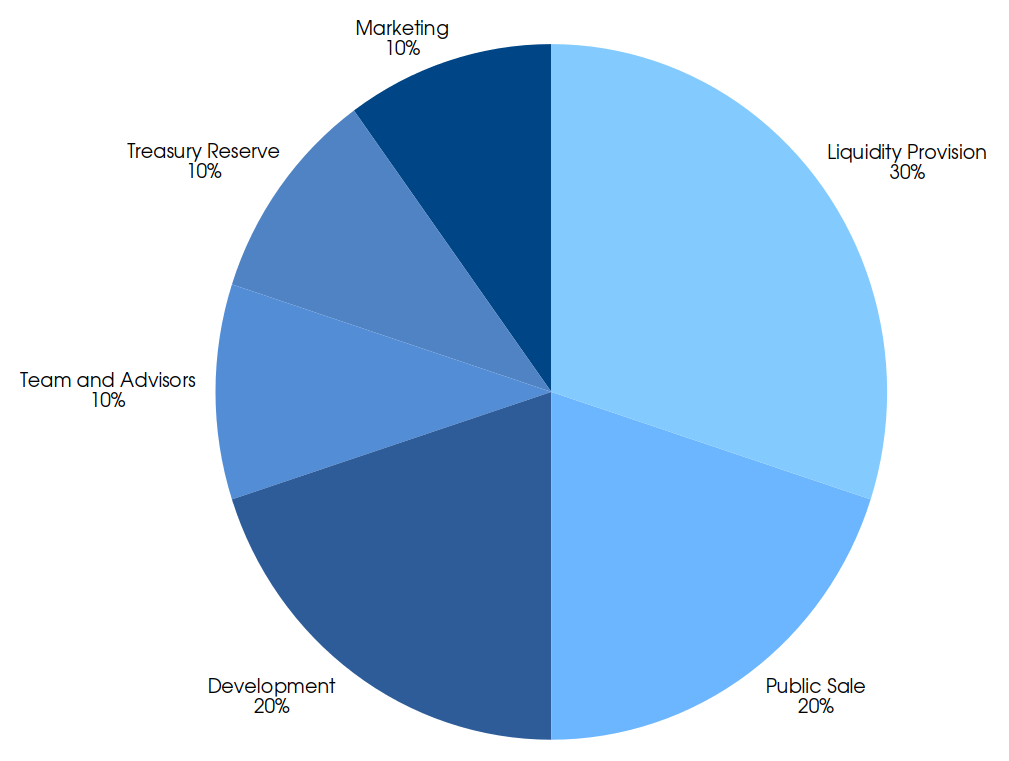

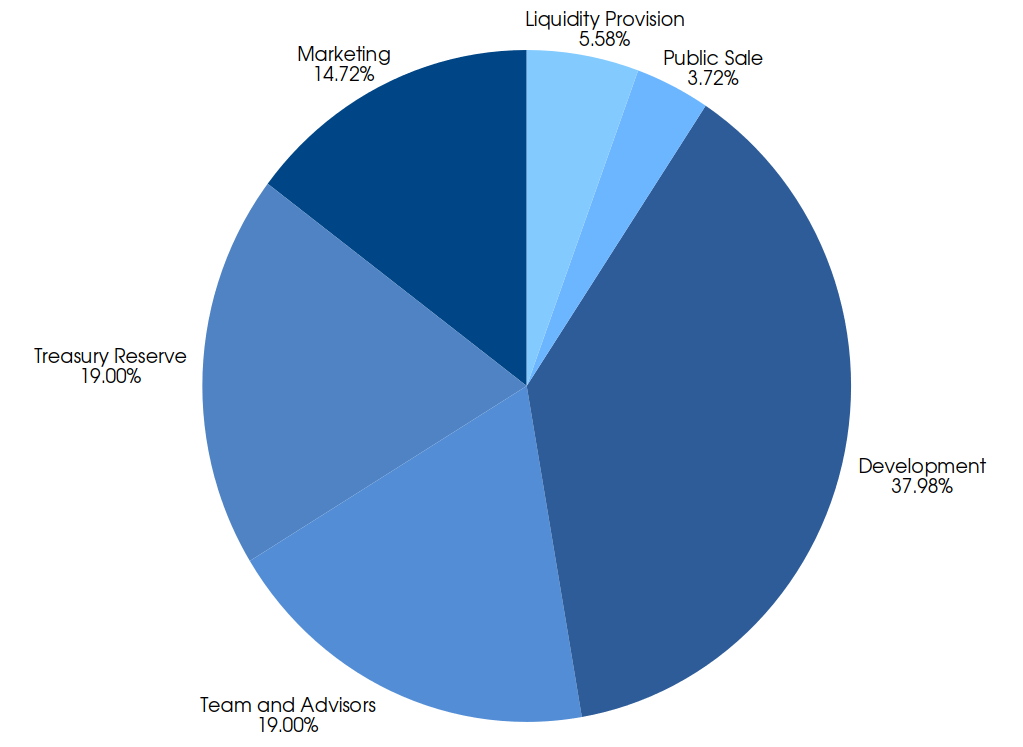

Adjusted Supply & Allocation

Palladium’s native token, PLLD, launched with an initial supply of 100,000,000 PLLD. Following the execution of structured burn events totaling 47,357,000 PLLD, the current effective supply has been reduced to 52,643,000 PLLD. Further periodic burns are planned until the supply reaches the long-term target of 30,000,000 PLLD. The table below reflects the current post-burn adjusted supply based on original allocation ratios.

| Allocation Category | Genesis % | Genesis Allocation | Current % | Current Allocation |

|---|---|---|---|---|

| Liquidity Provision | 30% | 30,000,000 PLLD | 5.58% | 2,938,857 PLLD |

| Public Sale | 20% | 20,000,000 PLLD | 3.72% | 1,959,238 PLLD |

| Development | 20% | 20,000,000 PLLD | 37.98% | 20,000,000 PLLD |

| Team and Advisors | 10% | 10,000,000 PLLD | 19.00% | 10,000,000 PLLD |

| Treasury Reserve | 10% | 10,000,000 PLLD | 19.00% | 10,000,000 PLLD |

| Marketing | 10% | 10,000,000 PLLD | 14.72% | 7,744,905 PLLD |

| Total | 100% | 100,000,000 PLLD | 100% | 52,643,000 PLLD |

Vesting Schedules

- Liquidity Provision (30% at Genesis, 5.58% Current)

- Lockup: None

- Vesting: None

- Burn Adjustment: 27,061,143 PLLD was burned from this category.

- Public Sale (20% at Genesis, 3.72% Current)

- Lockup: None

- Vesting: None

- Burn Adjustment: 18,040,762 PLLD was burned from this category.

- Development (20% at Genesis, 37.98% Current)

- Lockup: 6 months post-TGE

- Vesting: Gradual release from Month 7 onward, aligning with platform milestones (e.g., Swap launch, real estate tokenization).

- Sablier Lockup: https://app.sablier.com/vesting/stream/LK-1-4606/

- Team & Advisors (10% at Genesis, 19.00% Current)

- Lockup: 6 months post-TGE

- Vesting: Linear over 25 months to maintain focus on long-term success.

- Sablier Lockup: https://app.sablier.com/vesting/stream/LK-1-4607/

- Treasury Reserve (10% at Genesis, 19.00% Current)

- Lockup: 12 months post-TGE

- Vesting: Linear release, offering flexibility for unforeseen requirements and strategic expansion.

- Sablier Lockup: https://app.sablier.com/vesting/stream/LK-1-4609/

- Marketing (10% at Genesis, 14.72% Current)

- Lockup: None

- Vesting: 25% released at TGE, remaining 75% over the next 12 months to support sustained growth and user acquisition.

- Sablier Lockup: https://app.sablier.com/vesting/stream/LK-1-4615/

- Burn Adjustment: 2,255,095 PLLD was burned from this category.

These schedules prevent sudden token floods, safeguarding market stability and incentivizing ongoing project development.

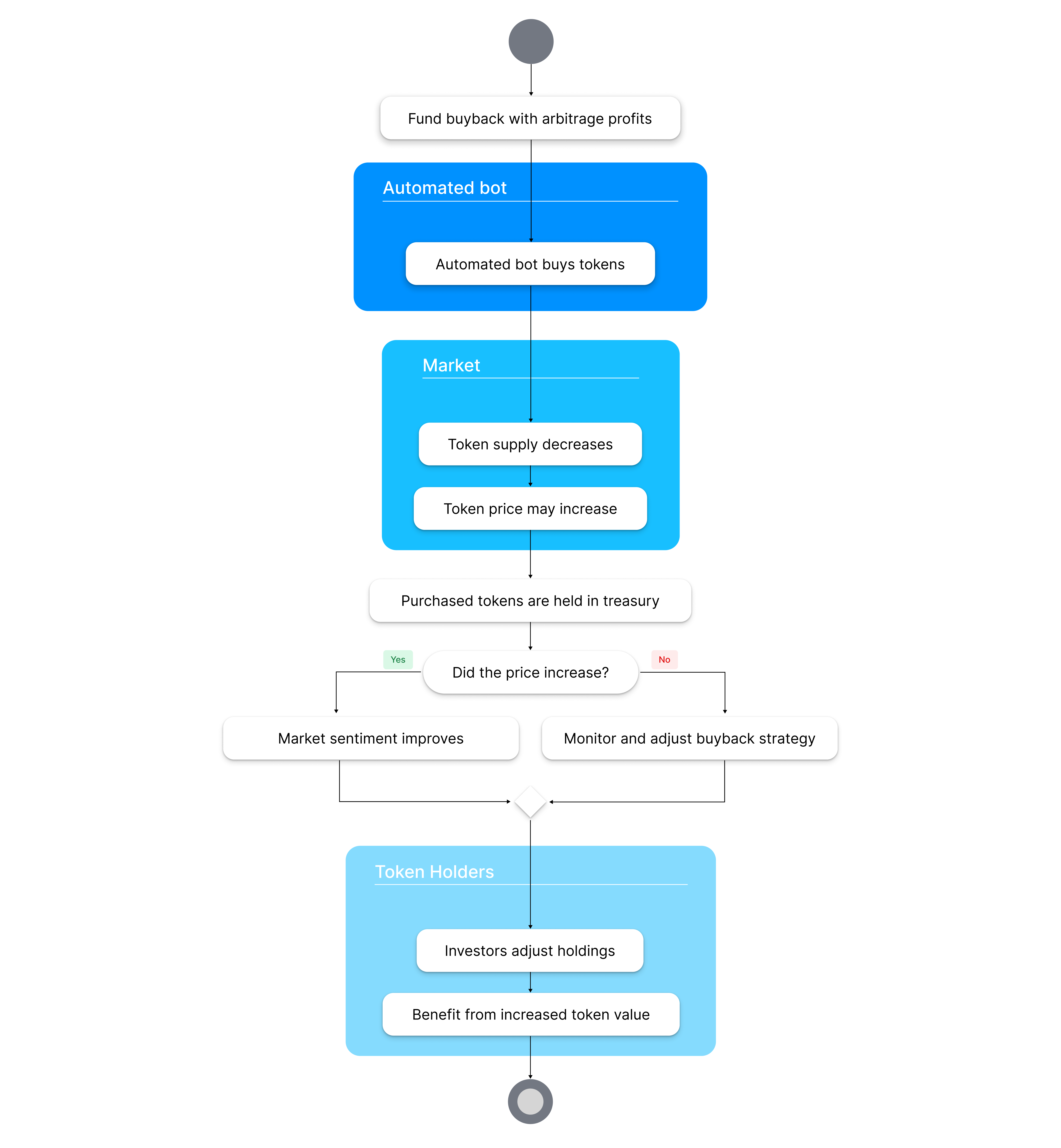

Buyback Mechanism

Central to Palladium’s sustainability is a profit-sharing buyback system, where a portion of trading returns fund PLLD repurchases:

-

Trading Earnings Profits generated from automated trading are channeled into the buyback pool.

-

Periodic Token Buys At randomized intervals, Palladium buys PLLD on the open market to thwart predictable front-running and speculation.

-

Supply Reduction Tokens are transferred to the treasury or retired, effectively shrinking circulating supply and potentially supporting the token’s market value.

-

Transparent Reporting Quarterly disclosures detail total tokens repurchased, expenditure, and transaction references for on-chain or exchange verification.

Burning Mechanism

To reinforce long-term scarcity and support sustainable token value, Palladium implements a structured, transparent token burning program. Burns operate alongside buybacks, further reducing excess supply and aligning the circulating token base with platform growth.

-

Historical Burns As of November 2025, a total of 47,357,000 PLLD has been permanently removed from circulation. These burns reflect both strategic treasury reductions and early-stage ecosystem optimization.

-

Target Supply Palladium aims to achieve a maximum long-term supply of 30,000,000 PLLD. This cap is designed to balance scarcity with sufficient liquidity for trading, staking, and fractional real-estate participation.

-

Ongoing Burn Schedule Token burns will occur periodically, with a minimum frequency of once per year, until the 30,000,000 PLLD circulating supply is met. Additional burns may be executed in alignment with trading profits, ecosystem milestones, or treasury restructuring events.

-

Verification & Transparency All burn transactions are executed on-chain. Burned tokens go directly to Ethereum Null wallet. Palladium publishes burn reports, which include transaction references, total burned amounts, and cumulative supply updates.

This mechanism complements Palladium’s buyback strategy, creating a deflationary pressure that enhances long-term viability and encourages rational, value-driven participation.

Implementation

Platform Architecture

- Real Estate NFTs: Deployed on a secure NFT framework backed by SPV-held properties.

- Trading Engine: Utilizes high-performance servers with real-time exchange data to seize trading opportunities.

- PLLD Swap: A dedicated trading interface planned for launch 6–12 months post-TGE, enhancing token liquidity and user convenience.

Roadmap

2025: Foundation Year - Completed

Q1 — Token Presale

- Launch the PLLD Token to power our trading engine and support further real estate tokenization development.

Q2 — Expansion of Automated Trading

- Scale up the automated trading operations by increasing liquidity and implementing advanced algorithms to boost returns.

Q3 — Launch Staking Platform

- Launch the staking platform to allow PLLD holders to earn rewards and strengthen long-term ecosystem stability.

Q4 — Release Swap Functionality

- Launch swap platform for seamless Palladium (PLLD) swapping on Ethereum blockchain.

2026: Expansion Year - In Progress

Q1 — Launch Presale of First RWA NFTs

- Launch the presale of our first RWA NFTs and start onboarding more real estate assets into our ecosystem.

Q2 — Launch RWA NFTs On-Chain

- Launch first Real Estate NFTs on-chain and begin distributing the first yields from property income to NFT holders.

Q3 — Token Burn

- Execute the next token burn to reduce supply and support token value through increased scarcity.

Q4 — Expand RWA Portfolio

- Onboard more real estate RWA NFTs, growing the portfolio and unlocking new passive income streams.

Conclusion

Palladium converges tangible real estate value with high-frequency algorithmic trading to produce a more stable and transparent blockchain environment. Through fractional NFTs, investors gain direct access to income-generating properties, while trading-driven buybacks anchor PLLD’s market performance. This unified approach aims to diminish speculation, expand market liquidity, and democratize prime real estate investing—offering participants a balanced, sustainable path forward in the digital asset realm.

References & Further Reading

- Deloitte: 2025 Commercial Real Estate Outlook

- IMF: The Rise of Digital Money

- EU MiCA, SEC, MAS, and FATF guidelines

Participation in Palladium entails risk. This document is informational only and does not constitute legal, tax, or investment advice. Investors should perform independent due diligence before making financial decisions.