What Is a Token Burn?

In blockchain and cryptocurrency ecosystems, a token burn refers to permanently removing a portion of a token’s supply. Tokens are sent to a wallet that nobody controls, ensuring they can never be used again. The effect is strictly deflationary: fewer tokens in circulation means each remaining token becomes scarcer, which can support price stability and long-term demand.

Palladium’s Burn Event: Scale and Impact

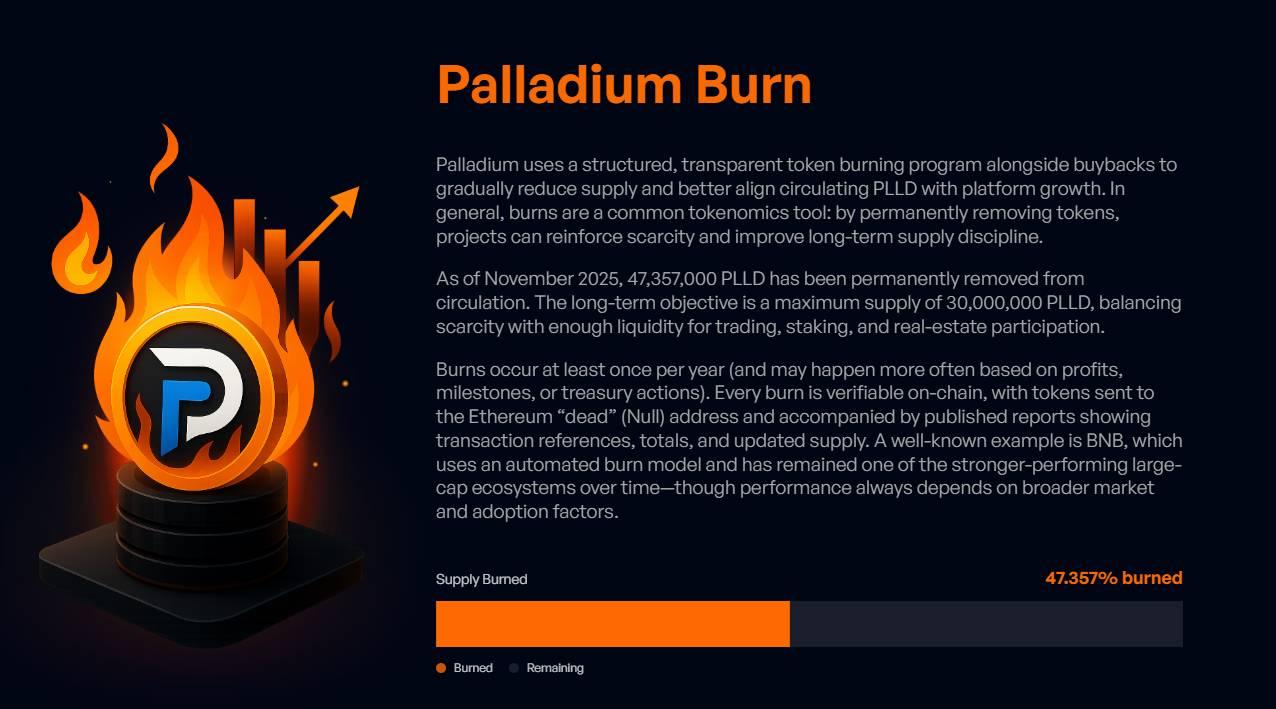

Palladium’s native token, PLLD, launched with a total supply of 100,000,000 tokens. Through structured burn events and strategic treasury actions:

- 47,357,000 PLLD has been permanently removed from circulation.

- This brings the current total supply down to approximately 52,643,000 PLLD, effectively eliminating nearly half of all tokens ever created.

These burns are verifiable on-chain, ensuring transparency for the community.

Why Palladium Is Burning Tokens

Palladium’s burn events are part of a broader economic strategy:

-

Reinforce Scarcity

Reducing supply helps create deflationary pressure on PLLD, a key tool for supporting long-term value rather than encouraging inflationary expansion. -

Complement Buybacks

Palladium’s automated trading engine generates profits that are channeled into buybacks. Some of these acquired tokens are then burned, further lowering supply. -

Align Tokenomics with Growth

The burn program is structured to continue periodically until the total PLLD supply reaches the project’s long-term target of 30,000,000 tokens. This balance aims to sustain liquidity and maximize scarcity.

Transparency and Verifiability

Palladium emphasizes openness in its burn process:

- On-chain transactions are publicly available.

- Burn reports include exact totals, blocks, and transaction hashes.

- Tokens are irreversibly sent to a recognized null address.

This transparency ensures that the burn is an immutable blockchain fact.

What This Means for Holders

While token burns do not guarantee price increases, they align the network with economic principles of scarcity and structural discipline. Major supply reductions, especially as large as Palladium’s, are often viewed positively by long-term investors because they:

- Reduce supply pressure

- Encourage buy-and-hold behavior

- Support market confidence around tokenomics

The project’s roadmap shows that future burns are planned alongside ecosystem expansions, highlighting how tokenomics plays a core role in Palladium’s strategy.

In Summary

The Palladium (PLLD) token burn is a strategic economic measure that reflects the project’s commitment to deflationary value, transparent on-chain action, and long-term sustainability. With over 47 million tokens burned and more planned, Palladium strengthens both its market position and its economic foundation.